Gold is coming off some technical short covering yesterday ahead of the tariffs that were implemented last night on $34 billion of Chinese exports. The anticipated slowing of demand for gold has contributed to the weigh down on prices. I imagine gold would have moved sharply lower following this escalating trade war if not for the recent weakness in the US dollar. Look for the precious metal to remain under pressure notwithstanding further geopolitical risk, enhanced buying interest from China and India as well as worsened negative sentiment to the US dollar which may offset some selling pressure. It appears the precious metal may continue to trade in a sideways consolidation pattern and remain fairly range bound. Gold is coming off from oversold levels with resistance around 1263 and 1267. Near-term support comes in around 1253 with the next downside target of 1247.

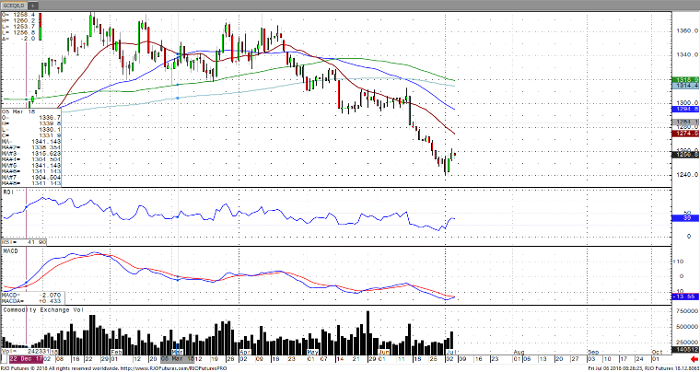

Gold Aug ’18 Daily Chart