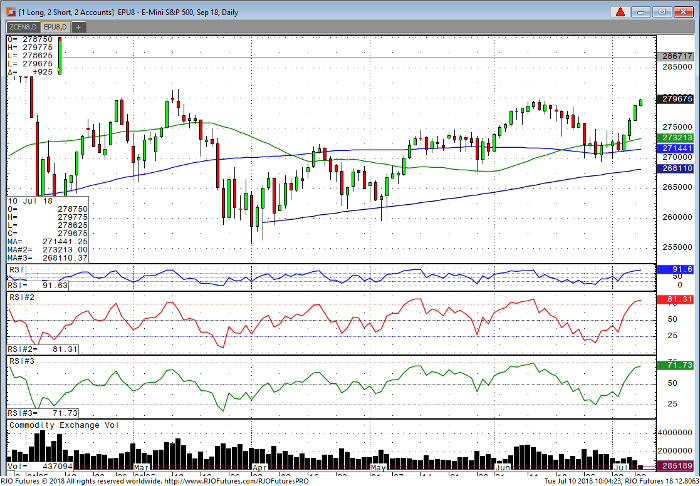

Looking at the E-mini S&P this morning we continue to grind higher, currently up $8 at 2796, extending yesterday’s big gains led by the Dow. The chart on the S&P looks very good having its fourth up day in a row holding well above 2731 which is the 50-day moving average. The gains have been impressive as of late and I believe we have entered what some refer to as a goldilocks environment, which means the economy is doing good, not overheating and simultaneously not struggling. So, in this type of environment the stock market tends to gravitate higher. Another very important item that S&P traders are paying very close attention to is tariff talk. The US imposed new tariffs last Friday and China retaliated with slapping new tariffs on the US. One would expect the market to sell off on the news but instead it has rallied and rallied sharply over the last week. My hypotheses here is simple, it is what us traders call sell rumor and buy the fact. Markets have a keen sense of knowing how the news will affect price action. And if one looks at headlines this week, its been all quiet on trade talk. Nothing out. So normally when we see no verbiage back and forth between both superpowers, the market will continue to crawl north. Now that can change on a dime, so traders should continue to be on alert for any tariff talk that crosses the headlines. In terms of economic news, its has been a quiet week but should get some action tomorrow on CPI, which the Fed will be watching closely to see if we see any tick up in inflation. If we should get a stronger than anticipated number, that could put a dent in the current market rally.

E-mini S&P 500 Sep ’18 Daily Chart