Global equity markets were mixed in the overnight with Asian stocks weaker and European stocks slightly higher. Chinese second quarter GDP growth came in softer than expected which may allude to the susceptibility of the Chinese economy in relation to the US economy in regard to these ongoing trade tensions following the implementation of tariffs on $200 billion of Chinese imports last week. Bank of America reported higher earnings of 33% before the open, which benefited from the recent corporate tax cuts as well as higher interest rates. Tech giant Netflix will report earnings following the close. The S&P 500 has forged a higher high to start the week but are near overbought levels with near-term support seen at 2795.00 and resistance at the March high of 2814.00.

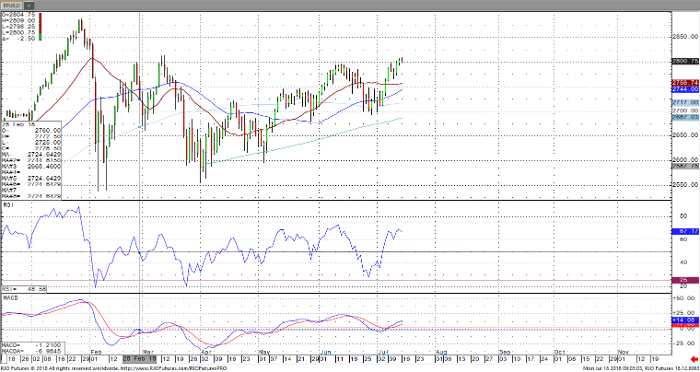

E-mini S&P 500 Sep ’18 Daily Chart