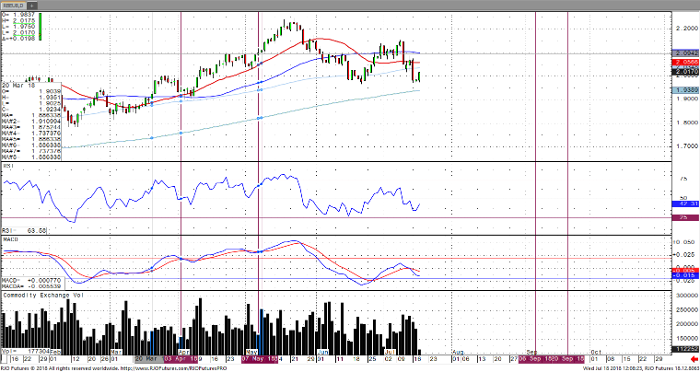

RBOB managed to hold off a lower low Tuesday, currently trading positive on the day but continues to have difficulty holding above the key 2.00 psychological level. The gasoline market appears fundamentally vulnerable with an annual surplus of gasoline stocks of 3.34 million barrels and a lack of consistent strong demand readings. API stocks released a surprise build Tuesday providing further downward bias, however, seasonal patterns provide for enhanced demand (June US gasoline sales rose 1%) as well as declines in gasoline stocks into the Labor Day holiday. RBOB is coming off oversold levels with support around 1.97 and resistance around 2.03.

RBOB Sep ’18 Daily Chart