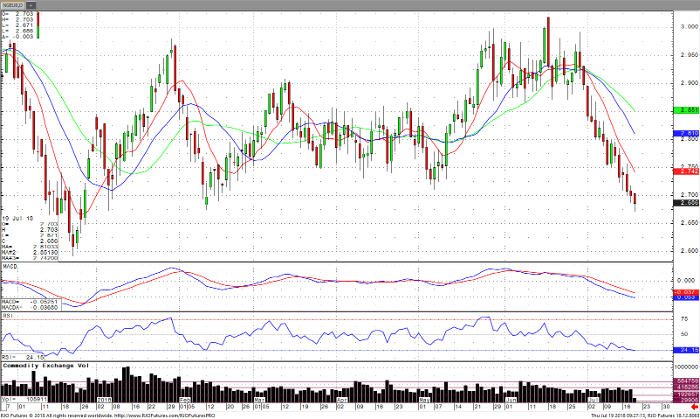

The Sep ‘18 natural gas futures contract is clearly down today. For five days now, the trend has been going straight down. It is reaching toward the bottom of the trading range and is challenging the Dec ‘18 low of $2.529. If it closes below $2.650 look out below. A close above the area of $2.800 is needed to reverse the trend and bring bullish forces back into play. Momentum studies are trending lower and are getting near oversold levels. Caution should be exercised, because we are still waiting for a divergence to change our bias toward the direction of the market.

The storage number today is 46 bcf, right around the 3-yr range. Last week’s number of 51 bcf was average at best. Production increases balance between normal or slightly below normal weather around the country and heat in the South and West. I still like the exposure to the short side of the market, with caution toward a change in direction due to a reversal in momentum studies like RSI and MACD.

Natural Gas Sep ’18 Daily Chart