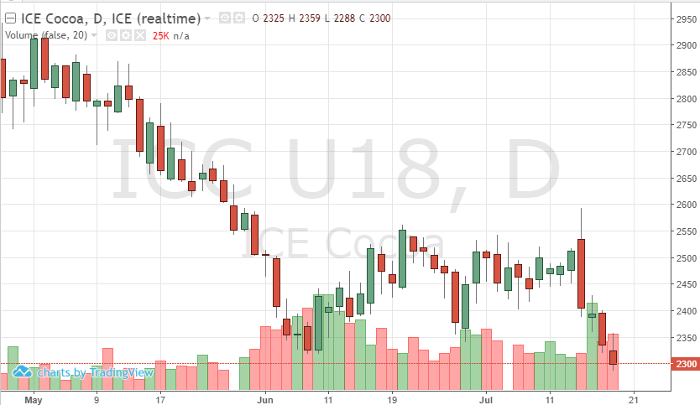

After the release of the European grinding data, cocoa traded in a 200-point range on July 16 and closed at 2406. The data showed a 7.3% gain in European grindings and would be normally viewed as a bullish release but instead we saw the opposite. Longs liquidated, profit taking took over the market. Technical support levels were broken and since the release we have seen NY September futures trade as low as 2288 as of Thursday afternoon. A continued close below the 9-day moving average will continue to hurt the technical side of the trade. The positive side of the European data is it shows demand is coming back for cocoa which has been something traders have been waiting for. The question now is supply better than anticipated?

The market is in a “wait and see” approach as the North American and Asian grindings will be released later this week. The North American data which will be released after Thursday’s close should be in line with Europe’s data. More positive demand news should lead to a rally next week – and if the technicals can take this market higher again. El Nino is also in the back of some trader’s heads. If weather comes back into play, supplies can be hurt further and could help cocoa futures head back to 2500.

Cocoa Sep ’18 Daily Chart