September silver is trading 15.55, up about 5 cents. The chart formation suggest downside pressure is waining. In my last article, I mentioned the downside pressure in silver was building when silver was 15.77. It washed all the way down to 15.18 before it recovered. If the market closes today around where it is now the bulls should be encouraged. The US dollar is trading in a consolidation to sideways price action. In other words, its price structure is weaker than when I wrote about it last. Sideways price action is very good for silver traders, specially those who integrate options, because they could get the play with protection. Again, contact me for trade ideas in silver right now.

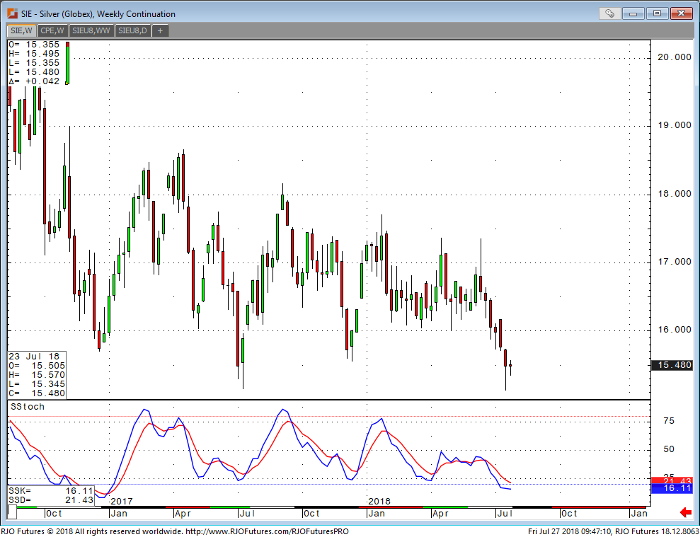

The technical outlook for silver suggest sideways price action and doesn’t appear to be going anywhere fast, at least not today. Actually, this is my favorite price structure. It allows opportunity for non-directional play. Although the White House is coming to some agreement with EU, US-China trade spate is still ongoing with no formal policy or trade negotiation between the two nations. We shall see what will come out of that. Next article, I will write about the recent development that could cause a potential spike in silver price. The weekly chart below in silver shows that last week’s lows needs to hold. Silver needs to trade above 16.50 to get the bulls excited. If the dollar recovers, low 15.00’s are likely.

Silver Weekly Continuation Chart