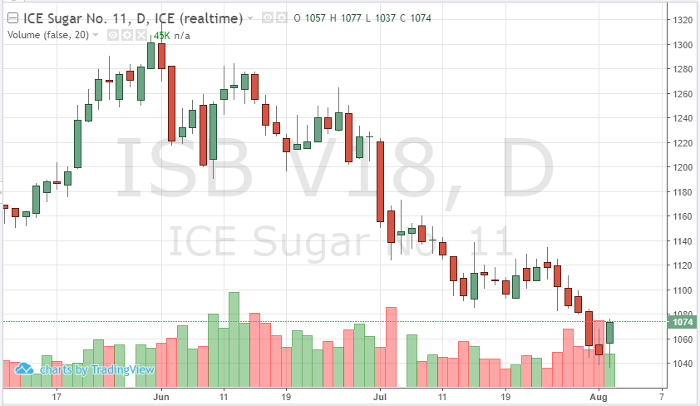

Sugar futures are attempting to recover from recent lows during Thursday’s trading session. October’s contract made new lows this week due to Brazil’s supply situation and reaching oversold technical levels. Sugar was unable to find support until 10.37 was touched, consolidation has led to a breakout and possible reversal. The focus had turned to India’s crop, monsoons and the sell-off in energy prices. Ethanol prices in Brazil also hit 10-month lows. Currency prices added to the pressure in sugar earlier this week. The market has now shifted its focus to bullish supply news in the top-producing areas of the world. With short specs way below record levels, traders will monitor COT reports and watch for addition short-covering heading into the weekend. To reaffirm a potential reversal, a close and hold above 10.85 will be needed.

Sugar Oct ’18 Daily Chart