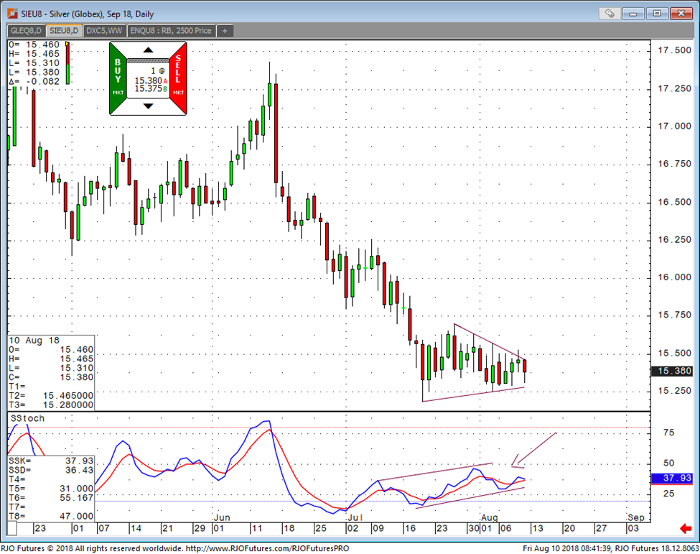

September silver is trading 15.40, down about 6 cents. The strength in the US dollar as shown below is putting a great deal of pressure upon the silver market. The last issue, I wrote about the dollar is in consolidation and poised for a breakout. What I find interesting is that gold is the only metal that is shown positive on the chart today. Silver has been in a lengthy consolidation as seen in the chart below. Breakout in silver is likely to come sooner than later. I suspect that safe heaven bid could help silver come out of this consolidation to the upside. With the Fed likely to consider more rate hikes, the dollar would continue to benefit from it. I still believe silver needs to trade above 16.50 to get the bulls excited. If the dollar recovers, low 15.00’s are likely in silver

The technical outlook for silver suggests tighter consolidation, the upside is favored for now. A break below 15.18 would likely set a fresh downside pressure for the September contract forcing the market to go below 15.00. Options trades seems to be an effective way to approach this market for a breakout type of strategy.

Silver Sep ’18 Daily Chart