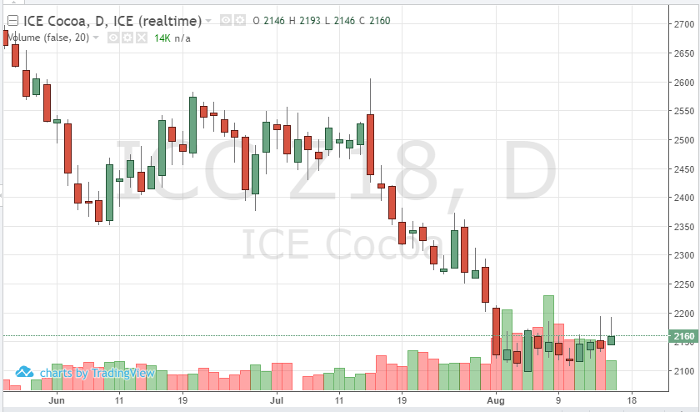

Recently, cocoa futures have been range-bound, 2100-2200 in the December contract. The currency trade, specifically the euro and pound, have held down prices in cocoa due to their weakness. Supply concerns may be able to push the market higher, above 2200, but with demand always in question we will have to wait and see. Also, global factors and an overall weak market tone has harmed all commodities across the board. The wet weather coming in West Africa is needed due to the previous pattern but shouldn’t be enough to affect prices in the short-term. Until some substantial supply/demand data breaks, look at the techincals for direction. A close above the 9-day moving average and a close above 2150 should help December cocoa breakout.

Cocoa Dec ’18 Daily Chart