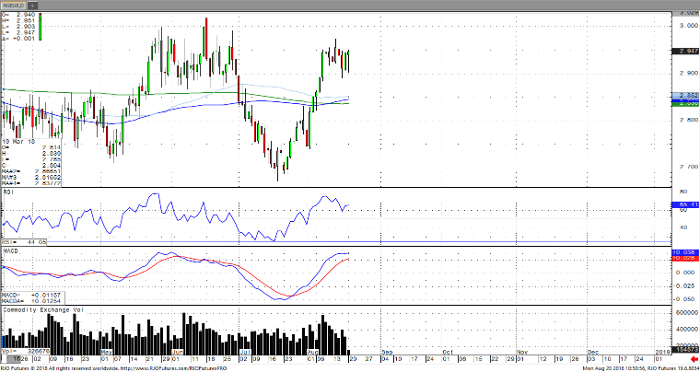

Natural gas for September delivery appears to be trading in a sideways pattern, consolidating between 2.900 and 3.00. The near-term temperature outlook does not appear to provide momentum for an upside breakout. However, warmer temperatures are expected in the long-term forecasts in the north and western regions indicating that there may be a delay in seasonal cooling, which may continue to provide underlying support. The weekly natural gas injection last week showed more supply moving into storage than expected but storage remains 20% below the five-year average. Momentum is trending lower from overbought levels with support seen at 2.919 and resistance at 2.975. Expect some back and fill action in the near-term.

Natural Gas Sep ’18 Daily Chart