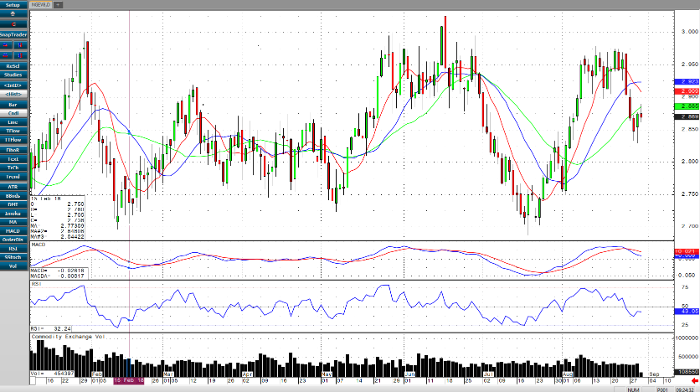

The short term trend in the October natural gas is sideways. The contract price seems to be settling between $2.800 and $2.900. A close below $2.799 will rekindle bear forces, while a close above $2.900 may turn the bull forces on and run back up toward the $3.000 mark.

Cooling season is ending in the United States. The market is being supported by warmer than normal weather throughout the Northeast and Midwest through the long Labor Day weekend. The momentum indicators are at mid-levels and starting to trend downward. A downward trend can signal a move towards lower gas prices.

The EIA storage report for today shows an increase of 58 bcf today.The amount of gas held in storage is below the 5 year average, it is also below the yearly average by 20%. A cautious bearish position is recommended, puts on October gas can limit losses.

Natural Gas Oct ’18 Daily Chart