The December cocoa contract continues to try to find its way but cannot gain traction in either direction. The supply concerns are not strong enough to overpower the lack of global demand for the soft. With wet, damp conditions in key growing regions and the concern of black-pod disease on the rise – which should lead to higher prices, trading ranges continue to tighten. Volatility in emerging markets are also hurting cocoa and adding to the risky sentiment felt in futures.

Technically, a close above the 9-day moving average, continued closes above 2350, mixed in with short-rally’s in the pound and euro – cocoa could be in line for a recovery and new trading range. Until we know if grindings will hit records we won’t know the longer-term trend for the market. Traders are taking a wait and see approach as we are heading into the last quarter of the year.

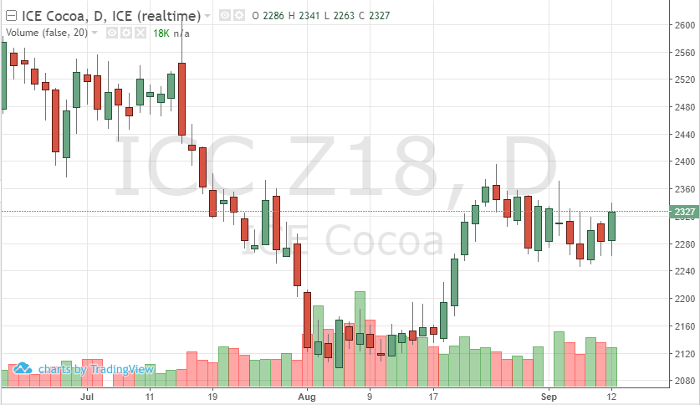

Cocoa Dec ’18 Daily Chart