Overnight global markets were generally mixed with the Shanghai and Australian markets showing small losses, with most other markets clawing out minor gains. The technical bias in the markets remains strong as the fear of the US/China trade war is not damaging investor sentiment. It might be too early to suggest but is possible that the beginning of inflation is being embraced by investors as a positive, improved pricing capacity by companies can add to profits. With the E-mini S&P sitting within relative reach to all-time highs and investors unruffled by US/Chinese trade wrangling the path of least resistance remains up. Close in support is at 2900 while resistance comes in at 2920.

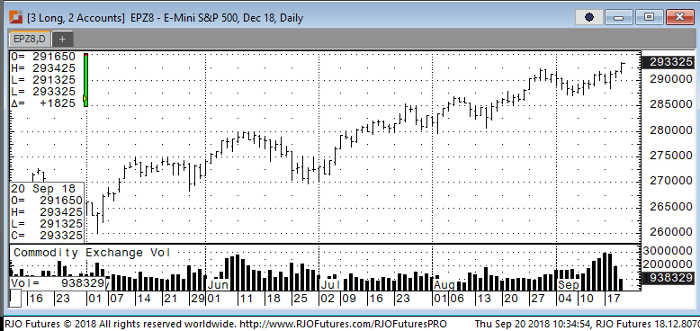

E-Mini S&P 500 Dec ’18 Daily Chart