Gold is trading higher in the early session coming off a weekly low on Friday with some weakness in the US Dollar. In the overnight, Barrick Gold has agreed to buyout Randgold Resources which will solidify Barrick as the world’s largest gold company by production. This acquisition alludes to the idea that the precious metal may be undervalued and may have longer term value as an asset. Some support may have been garnered by the further implementation of US and Chinese tariffs with the Chinese preparing to release a ‘white paper’ with details related to the ongoing trade war tomorrow. Gold has been consolidating and trading in a sideways pattern which suggests a market bottom may be in place with the precious metal looking ahead to the FOMC meeting on Wednesday. The central bank is widely expected to raise rates with the surrounding language providing insight into further rate hikes. Expect gold to remain range bound prior to the Fed with support coming in around 1193 and near term resistance seen around 1213.

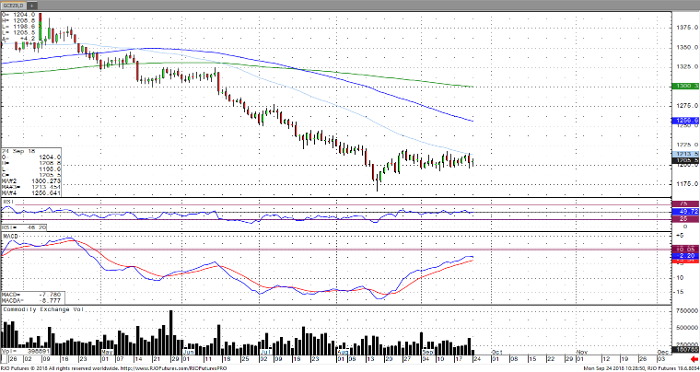

Gold Dec ’18 Daily Chart