Looking at the S&P this morning, we have some fragility due to ongoing weakness in China’s stock market which is currently in a bear trend. The ongoing budget battle in Italy is also weighing on stocks this morning. Currently, the 10-year yield on the BTP, which is Italy’s main 10-year bond, is at 3.40 which is a new contract high for this commodity. Often when you see big moves out of Europe’s bond markets, this means trouble is brewing and investors should start paying attention for any trickle-down effects in our bond and stock markets.

One very big negative I see in our stock indices is the Russell 2000. Yesterday, we had a lot of weakness in this sector and actually fell below the 100-day moving average for the first time in a long time. I point this out because the Dow, Nasdaq and the S&P are all above key averages, but traders should take note that we have seen the Russell lead in the past, and if this does prove correct we might have seen the highs for the year in our stock market. Nothing is guaranteed, but “warning signals” are developing.

The economic calendar is fairly quiet today, besides fed chairman Powell speaks at 12:45 central on wage inflation. Traders should be cognizant and watch for volatility if anything new is said. The Fed’s number one priority for continuing to raise rates is to see wages, which have been relatively stagnant, go up.

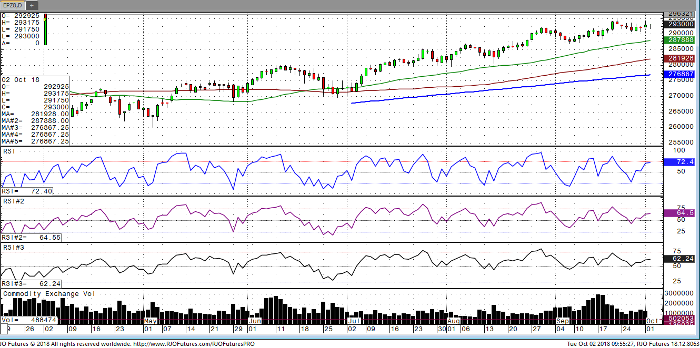

E-Mini S&P 500 Dec ’18 Daily Chart