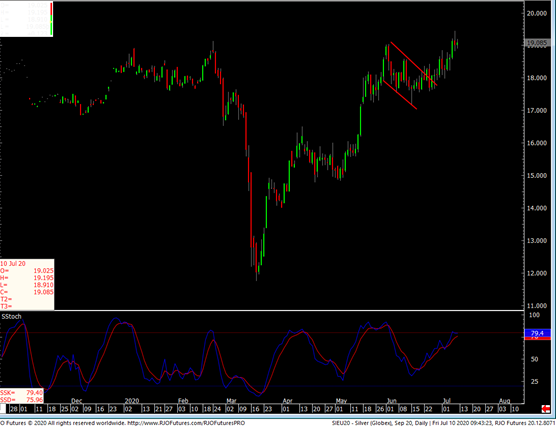

September silver is trading at $19.09 and up about 10-cents on the day. The surge in equity prices globally lead by China is definitely seeing as a supportive factor for strong silver performance. As you can clearly see here, front month silver is looking to take out $20.00. On the last issue, I wrote about the silver chart work setting up a potential flag on the chart and it has worked through that and is now heading to 20-dollars plus. As I have stated before, the Fed and world monitory authorities flooded the streets with cash as they are working hard to pull the world economy from the brink of total disaster. As we all know, this zero interest environment is here to stay for the foreseeable future. I continue to think that silver has a big run to the upside left to do. For the most part, everything on the negative side is already known, what is not clear yet is the pace of economic recovery. For now, silver will grind sideways to higher. ANY price break will be seen as an opportunity to buy rather than sell. Global markets continue to price-in new infection concerns. I think it is too early to talk “depression” but that remains to be seen. Markets will remain choppy as we navigate through this