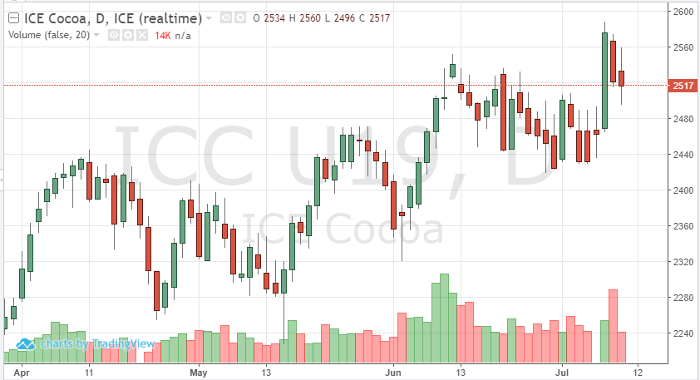

On the chart, cocoa prices have entered a new range. After Monday’s rally, traders have seen two down days. Profit taking and volatility in the currencies have weakened the market. Strong supply and demand news had the September contract headed to 2600 – but now that target is in question. Will the weather front headed to key growing regions in Africa hurt or help prices? If the rain is followed by dry heat, longer term production could be affected. In the short-term, bullish traders should consider buying calls if they want exposure. The chart looked to be forming a bullish flag, but Wednesday’s close may be showing us that this market has another idea in mind. Look for opportunities to enter the market on pullbacks and keep key levels in site, 2510 for support, 2585 for resistance.

Cocoa Sep ’19 Daily Chart