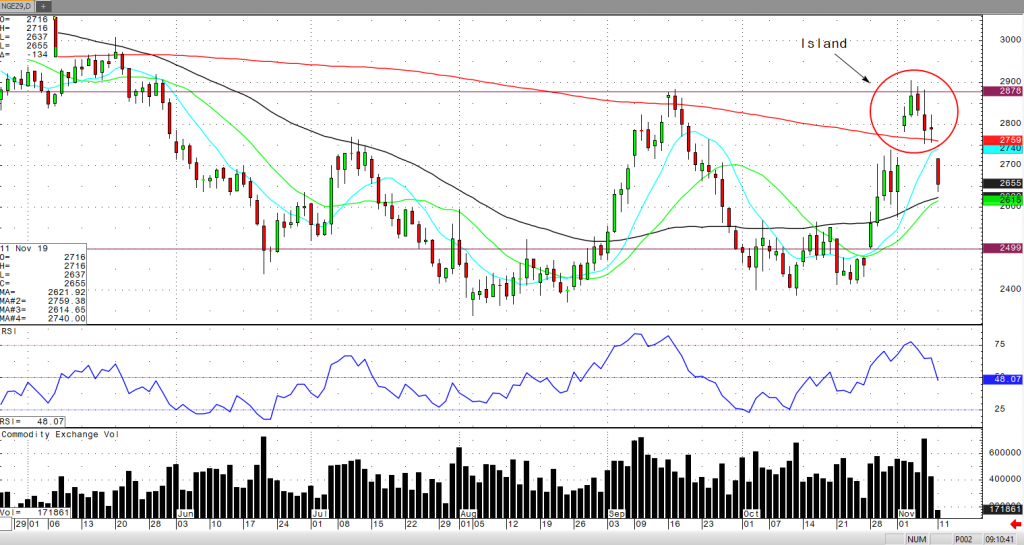

Commodity markets have reversals all the time. However, you see very few examples of a classic “Island Reversal”. With electronic trading, virtually 24-hours a day, it has become more rare to see gaps on daily charts without some unforeseen geo-politically driven event. But this is the natural gas that we’re talking about. This is a market that has become known for blowing up hedge funds. This Island Reversal comes after a 50-cent rally from roughly $2.40 to $2.90. Interesting to note that there are two gaps on the way up and of course these gaps occur on Sunday evening opens. Price discovery on the open of a new trading week. Now if this week’s trade action takes natural gas prices back towards the $2.50 range, and I believe it will, that’s where the first gap up occurred. Of course, we do need to see another day or two of downside follow through to confirm an actual reversal but an “Island Reversal” is perhaps the strongest technical indicator.