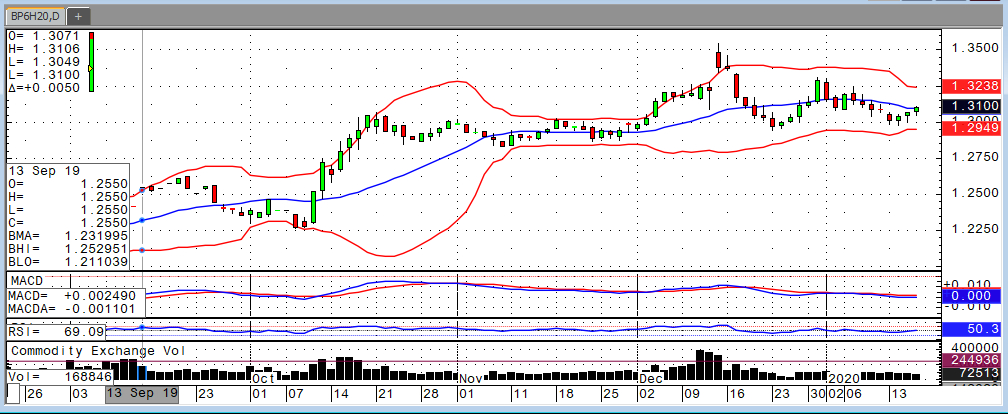

March U.S. dollar futures attempted a rebound during Thursday’s trade, settling at 97.04 while foreign currencies mostly finished lower. The British pound was the notable exception, finishing 0.37% higher for the day despite soft CPI data out of the UK on Wednesday. When nations are not meeting their inflation targets, lowering interest rates is the traditional path to higher domestic prices. The fact that this soft inflation data did not have a larger negative effect on the currency is a bullish factor. Furthermore, the pound respected technical support at the 1.30 level earlier in the week before moving higher. From a fundamental standpoint, it appears as though Brexit will be resolved in the near-term, which could help promote Boris Johnson’s business-oriented political agenda thus boosting demand for the UK currency. The Japanese yen looks the weakest of the major foreign currencies. Given the positive global sentiment, the yen has sold off to new lows in the March contract. If worry returns the markets, it is likely the yen will bounce higher given its safe-haven characteristics, but the overall pattern is very weak. The direction for currency futures will ultimately be dictated by the greenback. As of now, the path of least resistance in the U.S. dollar is pointed lower. This will prove to be true if the Fed must cut rates again in 2020.