The final week of May produced relatively significant moves across various asset classes, but the most noteworthy would be the US Dollar Index breakout of its range to the downside since 26 March.

The USD still resides within the larger range between 98.00 and 100.00 that has been in play since the end of July last year. But at the close of the week, price tested support at 98.00, and this week may resolve whether the USD is likely to continue its journey below 98.00 and possibly to 95.00

Economically, aside from the continued gains in stocks, there appears to be no clear signs of a confirmed recovery from the market’s initial shock in February and March. Unemployment has reached Great Depression levels and the budget deficit is back at extreme highs (a live update of U.S. debt can be found here: https://www.usdebtclock.org/)

In addition, civil tensions are increasing ahead of November’s elections with rioting in several cities. There are layers of socio-economic factors currently in play, which are adding to concerns.

However, it should be noted that despite the current unsettled sentiment, the market has shown remarkable resilience and opportunities continue to present themselves, provided appropriate risk management strategies are adopted.

As we head into the first week of June 2020, key economic calendar news events to watch out for this week include the following, with Friday’s Nonfarm payroll and Unemployment rates likely to draw especial attention:

- ISM Manufacturing PMI – Monday.

- ADP Nonfarm Employment Change – Wednesday.

- Crude Oil Inventories – Wednesday.

- Initial Jobless Claims – Thursday.

- Nonfarm Payrolls – Friday.

- Unemployment Rate – Friday.

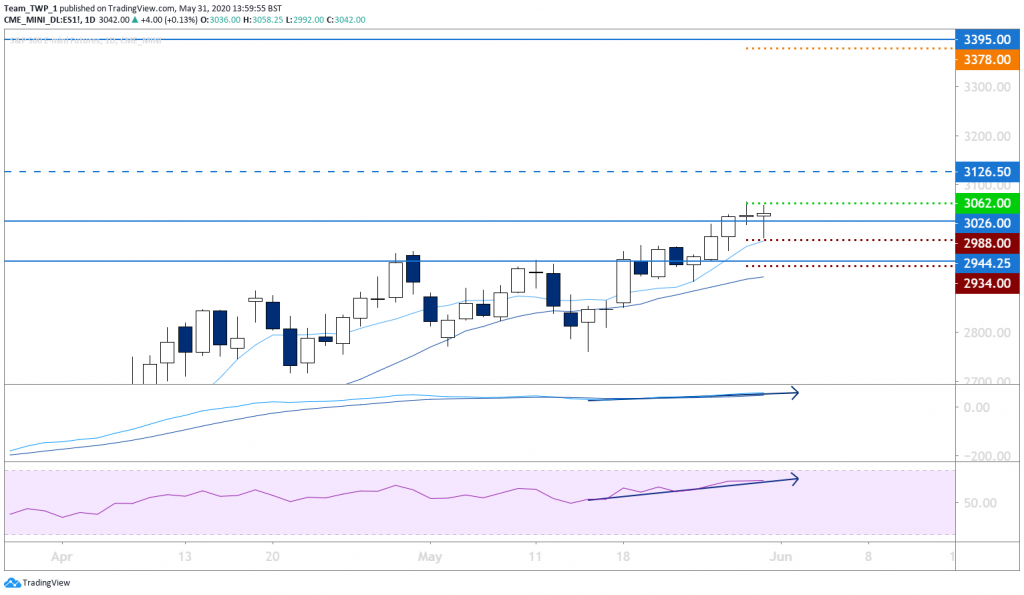

E-mini S&P 500, Daily, Bullish

The weekly E-mini S&P 500 now shows a subtle uptrend and price has broken above significant levels at 3000 and 3025. Both momentum indicators are trending higher, supporting a bullish sentiment.

The daily chart has broken out of a consolidation to the upside and produced clear higher-lows and higher-highs.

Price is now retracing back down to the moving averages (MAs) and created a bullish-indecisive candlestick. An entry above the high of this candlestick around 3062 may provide an entry into the next leg up if the trend resumes.

A stop-loss below the low of the candlestick around 2988 may provide a tight exit and more aggressive reward-to-risk approach.

Alternatively, a stop-loss below the recent resistance level at 2944 may offer additional technical protection.

There may be minor resistance around 3125 and significant resistance around 3395-4000, in which case exiting the trade could be considered prudent.

Should price during the next session break the low of the candlestick before breaking the high, the trade becomes invalidated.

Traders may consider taking partial profits at a 1:1 target to mitigate risk.

Risk management will be key, so a stop-loss is imperative, in order to protect capital exposure against unforeseen outcomes.

Sugar No.11, Daily, Bullish

The weekly Sugar chart now shows a subtle uptrend and price has broken above significant levels at 10.50. Both momentum indicators are trending higher, supporting a bullish sentiment.

The daily chart is trending and has produced clear higher-lows and higher-highs.

Price is now retraced back down to the MAs and has created a bullish swing-low and a follow-through candlestick.

An entry above the high of this candlestick around 11.02 may provide an entry into the next leg up if the trend resumes.

A stop-loss below the low of the candlestick around 10.45 may provide a fair reward-to-risk outcome.

There may be minor resistance around 11.71 and significant resistance around 12.80, in which case exiting the trade could be considered prudent.

Should price during the next session break the low of the candlestick before breaking the high, the trade becomes invalidated.

Again, traders may consider taking partial profits at a 1:1 target to mitigate risk.

Risk management will be key, so a stop-loss is imperative, in order to protect capital exposure against unforeseen outcomes.