As the summer starts to come to an end, we look ahead to fall activities and holidays. Will the demand for cocoa be down due to Covid and classroom closures? What will Halloween look like in the U.S.? All these unknowns have investors guessing on what earning will be for the major chocolate/food companies. If data comes in better than expected look for the cocoa recovery to continue.

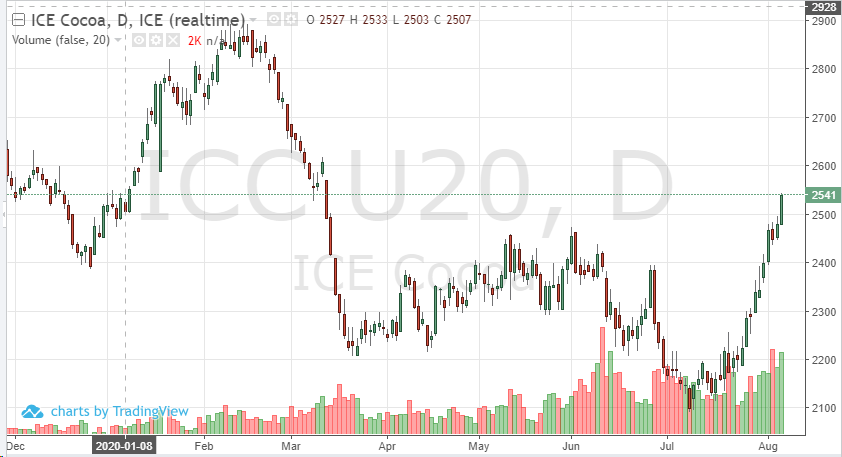

Demand has been the weak link for cocoa prices, but now it may be turning around slowly. Production news has been coming in bullish, technically cocoa continues to close above the 200-day moving average and the currencies are supporting this recent move as well.

Weather premium may also come into play supporting these new prices in the futures as key growing regions have reported lower rainfall totals. Traders should monitor the charts and resistance at 2585 in the short-term.