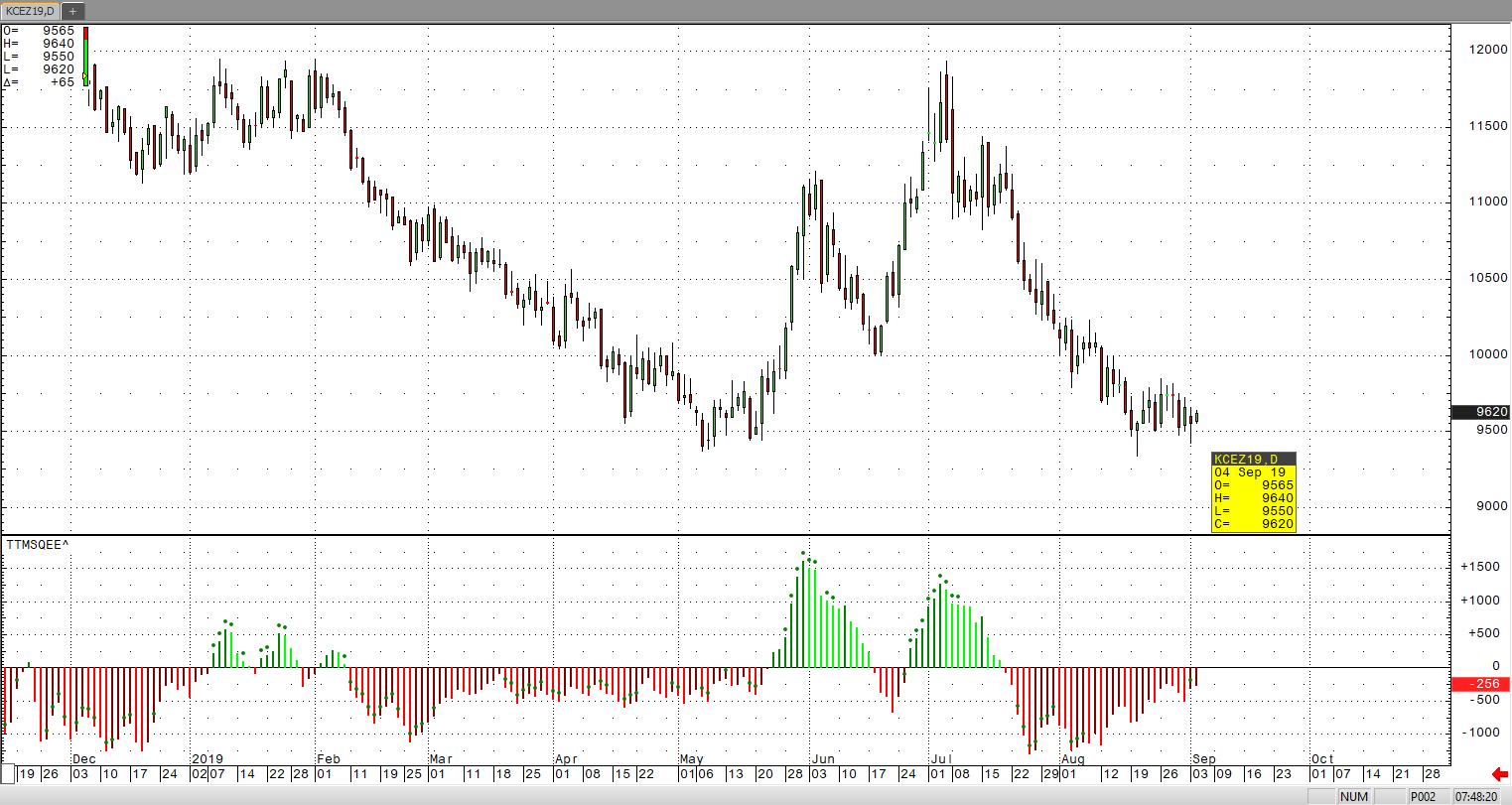

Although December coffee prices have met firm resistance at the 9750 level, support levels are holding strong. In my last article, I had outlined the key reversal up that may be taking place in December coffee prices. The reversal up looks to be from the August 20th price action, where the high was 9565 and the low was 9340. This technical daily candle looks to have precipitated some good follow-through support. Key producers in Columbia may have added some support to December coffee prices, but offsetting any potential bull run is the currently bearish news from record high supply numbers from Brazil last season. So much of that supply needs to be met with strong demand, and with the U.S. stock market continuing to endure massive volatile swings, lack of resolution with ongoing U.S.-China trade talks, I would suspect it will be quite a bit of time until December coffee makes a bull run back to the 100 level.

There should be solid support at the 9500 while the consolidation in price action takes place. Yesterday’s low of 9420 falls short of the 9340 reversal-up day. Upside resistance comes in around 9750, and a break above this well-defined range could signal a visit back to the 100 level.