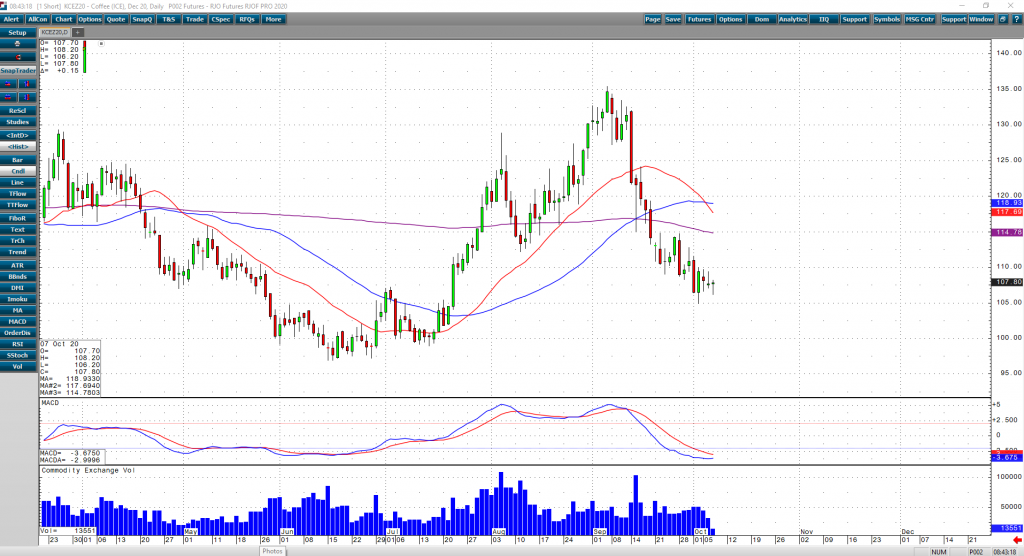

December coffee prices are targeting key support levels on slowly growing demand. The 100 level in December coffee hasn’t been tested since mid-July of this year, and since the promise of more and more States ramping up occupancy levels in restaurants and coffee shops grows, a stimulus package is still required to inject stronger demand levels across all commodities. While the stimulus negotiation debacle continues, we can expect that demand levels will not return in the near term and coffee prices should be comfortable below 110.

From a technical perspective, a recent (and aggressive) dive below the 200-day MA (resting at around the 119 level) is bearish, and likely will see follow through selling to the key support area of 100. We also can also make notice a consolidated bear pennant which if fulfilled (as a continuation pattern), could push December coffee prices to at or about the 100 level. I would expect a continued selloff at this time. There are several strategies that traders can apply in this situation. Call or email for specific strategies.