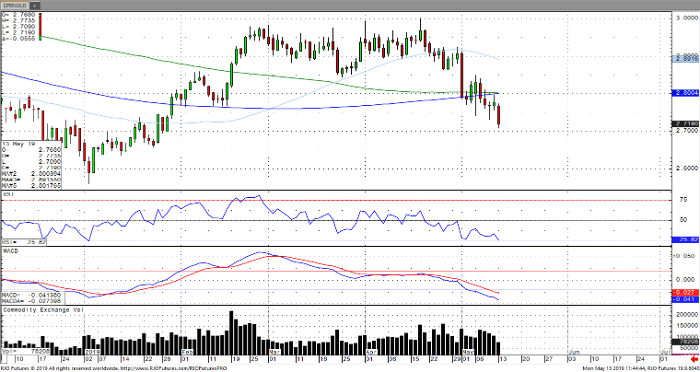

Copper remains under pressure and has fallen to its lowest price since January, following reports that China will retaliate and impose tariffs on about $60 billion of U.S. imports after the U.S. raised levies on $200 billion in Chinese goods from 10% to 25%. Copper finished last week down 4.45 cents or 1.6% and has largely followed the Chinese equity market lower with the Shanghai Composite down over 13% in the last month alone and the yuan turning bearish trend after being down 1.3% last week. Shanghai exchange copper stocks saw their largest weekly decline since last September and reached the lowest level since February. The industrial metal remains bearish trend and is likely to continue to experience headwinds with the ongoing US-China trade rhetoric with the current range seen between 2.71-2.84

Copper Jul ’19 Daily Chart

If you would like to learn more about metal futures, please check out our free Fundamental of Metal Futures Guide.