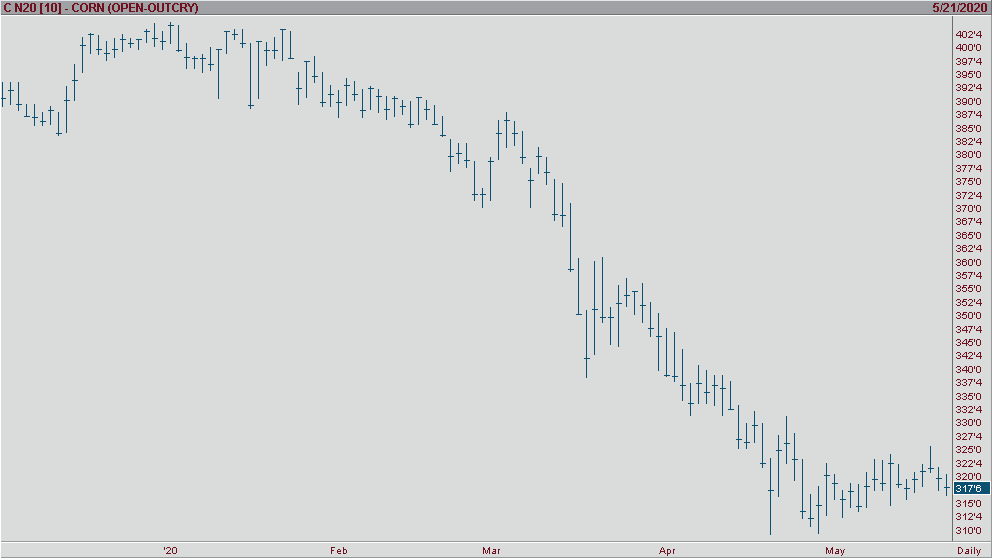

Corn futures continue in a consolidation trading sideways waiting for a catalyst to push the contracts to a new low or high. The re-opening of the global economy should be positive for the corn market in the months to come, since fuel demand should see an increase. Although a shortage of corn is not expected in the new season, corn contracts sitting at a five-year low and traders expecting seasonality patterns to push and support higher prices should be evident. According to the latest EIA data ethanol stocks in the U.S. have begun to decline. This is a consequence of the weakening of isolation measures that we originally put on in cities across the globe. Traders see that corn is generally positive technically with good support in the area its consolidating at and may see an upward correction in the near term.

July corn has price support at 315 ¾ and a break of this should see a move to 314, momentum studies should be watched as this will help traders identify oversold levels at this support. A break of resistance at 319 ¾ should accelerate a move to test 322. Traders will watch for short covering to move past these levels of resistance and an end to the consolidation that we have seen.