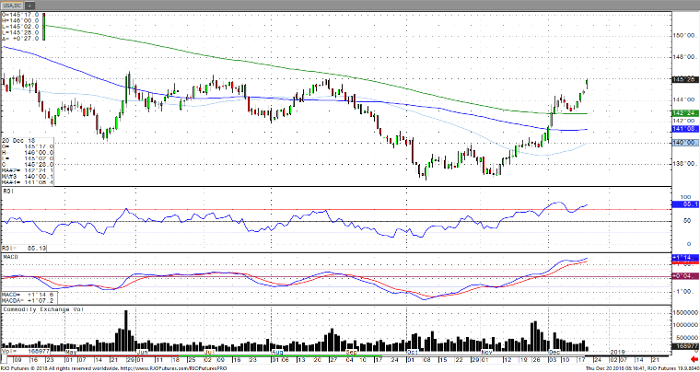

The Federal Reserve raised interest rates by a quarter of a percentage point which will bring the federal funds rate between 2.25% -2.5%, the ninth such increase since the FOMC began ‘normalizing’ rates since December 2015. Fed officials pulled back on their projection of interest rate increases from its previous forecast of three to two over the next year with the median projection of the ‘neutral rate’ moved lower from 3% to 2.75%. The neutral level is one that neither stimulates nor slows the economy. The tone was not sharply ‘dovish’ as the committee included a revised statement that more rate hikes would be appropriate as it would “continue to monitor global economic and financial developments and assesses their implications for the economic outlook.” Slight adjustments were made to their economic projections indicating lower inflation and slower growth. Fed officials expect core inflation, which does not include energy and food, to come down to 1.9% from an earlier projection of 2%. GDP expectations for the year were lowered from 3.1% to 3.0% and 2.3% from 2.5% the next. The yield on the benchmark 10-year yield fell to 2.782% after the announcement before retracing, hitting the lowest level since May. The 30-yr bond market is immediate term overbought with the next upside target seen around 146-28 with support around 144-20.

30-Year Bond Mar ’19 Daily Chart