Overnight:

The crash, and the BOUNCE. Be conscious of the idea that that may be “it” on the downside for now. We saw the “heart attack” drop at the 5pm open last night, and then a rally ensued overnight. We saw the NASDAQ and SPY correct more the 10%, and -8.1% in fairly short order, but bear in mind we still have elevated volatility that it may take a week or 2 to work through. All remains to be seen, but those are my most recent thoughts on the recent bout of volatility.

Global Indices:

USA – SP500 +0.92, Nasdaq +1.66%

Europe – GER +1.23%, FRA +0.81%, UK +1.07%

Asia – Lower across the board, Shanghai -1.86%, KOSPI -1.00%

Futures Markets

Currencies:

Plenty of immediate-term oversold signals in Foreign Currencies were triggered last night (All bullish trend)

GBP, Euro, Swiss, and CAD to name a few, as the U.S. dollar registers immediate overbought/bearish trend.

Energy:

*Crude Oil registers an immediate oversold signal, while flirting with a trend breakdown (but its holding). News of weaker expected demand in the fossil fuels market assisted in the near-term momentum breakdown in Oil prices.

*Nat Gas also registering immediate oversold yesterday, followed by a 3.00% bounce in the overnight.

*Energy remains bullish trend and one of our favorite “longs” in our current “stagflationary” economic backdrop

Keeping in tight this morning, Good luck to all!

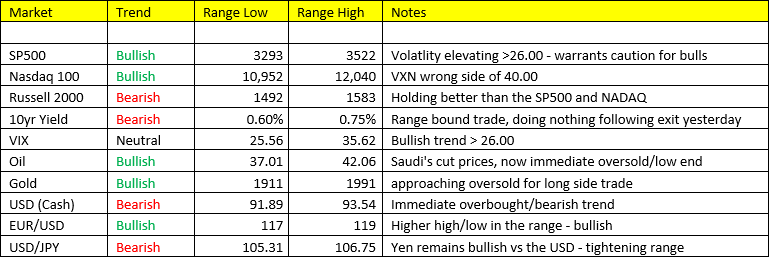

Actionable Levels