We were expecting to here from OPEC yesterday, with regards to their decision on increasing Oil production. From what I’m hearing that decision has been delayed until today, and I’m not quite sure when exactly we’re expected to hear back. Expectations for a 500K bbl increase in production by members is the benchmark, and I’ve read they may come in just under at 400K bbl. Typically the July 4th weekend is considered “peak demand” season, but this year is certainly the exception for that we think. Oil, for the first time in a while, signaled immediate OB in our model coming into the session, and Oil bears (if there’s any left) got some respite with an approx. 1.50 pullback from the highs that reached above 76.00 early yesterday. Oil, no longer signaling OB today. We remain cautiously bullish here within our range model, and expect to see some back and fill in coming weeks.

On to the June Non-Farm Labor Report: An increase of 700K increase in jobs in June is the benchmark forecast vs 559K prior. 5.7% unemployment rate which is expected down from 5.8%. We ran through 3 possible scenarios yesterday, and now it’s game day. We’ll know when we know.

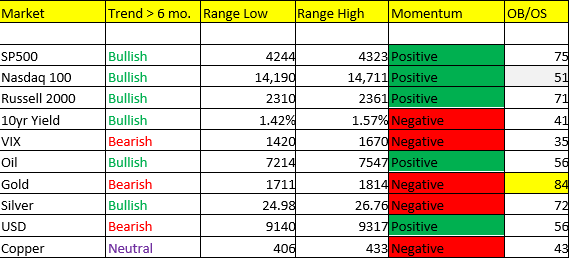

Yields are ticking down ahead of the number and Stocks remain firm. Our IVOL signals for stocks still suggest the market is NOWHERE near complacent, which means the upside can continue. We’ve seen in recent weeks a net SHORT position in the US Small Cap Index (Russell 2000), and more squeeze could be on deck for the bears. The USD continues to sense a taper is coming from the Fed, and the ECB went dovish on monetary policy back in mid-June which is also contributing to the squeeze for the USD bears. I’m watching this very closely for possible entry points on the short side for the USD, but also acknowledging that Scenario 4 (a bullish scenario for the dollar) is a probable outcome for this oncoming quarter.

T-minus 10 minutes to the number, I’m going to keep it right here for now.

If we don’t speak again today, I hope you all enjoy your long holiday weekend, and stay safe out there. God bless the USA!