“Remember when I asked for your opinion? Yeah me neither.” – The stock market to every political narrative

Good morning,

The rundown:

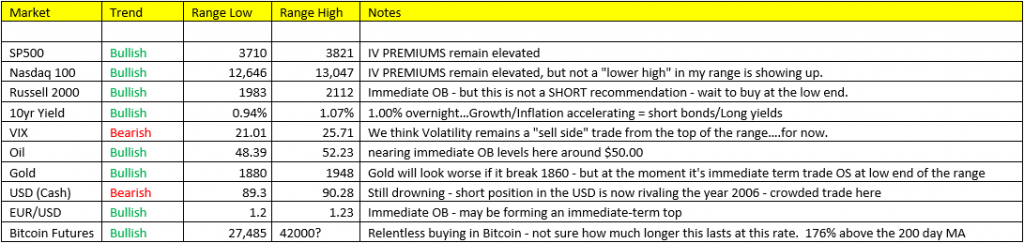

Stocks: that’s right, fresh All-time high’s yesterday, and of course “all-time is a long time”. Stocks don’t care about hooligans storming the capitol, just like they didn’t care when our major cities were being torched by ingrates this summer. Hello! McFly…It’s the cycle! It’s always about the cycle! Growth accelerating/inflation accelerating through the first half of 2021 as y/y comps of macro data and corporate earnings and profits may perhaps express the greatest rate of change acceleration since post WW2 – Scenario 2 in the model remains our call until further notice. On that note, stocks are now immediate OB within our range analysis – scale some back.

Yields: the 10yr yield is up again overnight to 1.09% ahead of the US Unemployment report due out at 7:30am CST. Perhaps the most significant development this week was surpassing the 1.00% level in 10yr yields as growth and inflation is set to continue their acceleration through Q1/Q2 2021. We’re trade immediate OS this morning in the 30yr and 10yrs, trim some, so we can replant (get bigger) when yields move back to the low end of our range.

US Dollar: No coincidence that the dollar has ceased its decline this week as yields pressed through 1.00%. But recognize that this trade isn’t likely to get too far on the upside in the near-term. We do believe the Dollar has entered a secular bear market that may last for many years to come. We’re still sellers of USD AT the top end of our range within the longer bear market cycle. BONUS: gold and silver got hit overnight. Gold is now at the low end of the range, remains bullish trend, but not one of our favorite places to be at the moment in a rising yields environment. Remember up yields = up dollar = down gold, and this is precisely the action we’re seeing today. Ultimately we expect gold to remain range bound for the near-term.