Week/Week Review – Another Scenario 2 week it was indeed….

SPY +1.2%, NQ +1.1%, RTY +2.5%

VIX -7.5%

Gold +0.3%, Silver +0.9%, Platinum +11.0%, Copper +4.4%

USD -0.7%, Euro +0.6%

Oil +4.6%, RBOB +2.5%, NG -0.4%

Do those numbers represent ANYTHING in which you’re watching/hearing about in the evening news or reading about on the “click bait” focused ZeroHedge? The answer is no. So I’ll remind you once again, it’s not about what makes headlines news OR drives click bait on the internet (Doom and Gloom sells, and drives ad revenue and “clicks”) – it’s about the cycle, it’s always about the cycle! Growth/Inflation Accelerating.

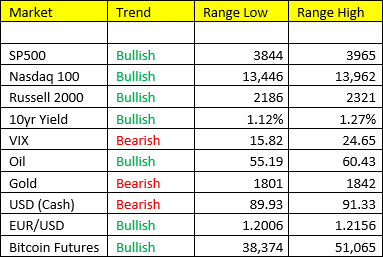

Yields pushing higher – as we’ve been calling for. We still think the 10yr yield has a long way to go throughout the course of the year! 1.50-1.60 is what we’ve been looking for, but it may be closer to 2.00%. Short bonds remains a core position. We’re crushing this trade at the moment, along with our short Eurodollar position.

Gold is struggling, Silver, Copper and Platinum aka semiconductor metals are killing it this morning – remember, Gold is a currency and vastly underperforms in Scenario 2. Not to say that we won’t come back to Gold at a later time, just not at the moment.

USD- I’ve been waiting for a turn in the dollar, because we believe it may begin to mirror the interest rate markets. Rising rates = borrowing money more expensive, in turn raising the value of the USD. I know Fiscal stimulus is highly deflationary for the USD (inflationary for risk assets), but we do see a period of strength for the USD headed into mid-year. We’ll see if this call comes to fruition, it is a bold prediction based on the amount of liquidity and fiscal stimulus being provided by the Fed and US Treasury.

Good luck today,