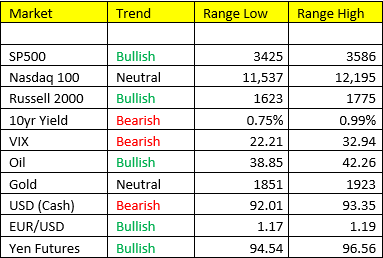

-Oil prices have continued their thrust higher….+13% this week alone and moving back to bullish trend in our model. The laggard of the commodity space looks to be breaking out. We’re buyers of Oil going forward, but currently immediate OB at the top of our range.

-Stock Market rotation continues. There’s no stopping it now, and we’re likely in the early innings of this move. Tech heavy Nasdaq is -3.1% on the week, while small cap Russell 2000 stocks are +5.5% on the week. Higher yields and Vaccine news are the fuel to this move in the large/mid cap to small cap rotation.

-USD stopped going down this week. We bounced off the low end of our range closer to 92.00 on Monday, and come into today’s session at 93.08. I’m not looking for anything significant in terms of upside for the Dollar here, but connecting the dots it all makes perfect sense. Higher yields in rates, a transition to a more “friendly” growth outlook in 1H2021 (Scenario 2), and direct competition from foreign central banks i.e. the ECB’s stimulus plans. I’m largely looking for the Dollar to establish a trading range going forward. We’ll keep buying and selling the extremes in our range analysis.

-Bitcoin- I realize that this is wildly unpopular with many in this space, and I’m sorry that I’m not talking about Gold and Silver this morning in this spot – but the facts are that BTC has outperformed every asset class across the board for the past few weeks. My initial skepticism of BTC was largely due to its “youth” as an asset class, and how it would perform across the full investing cycle. Some of those questions have been answered, some remain, but the facts are that we’re bullish trend, and carrying a 16229 – 14275 trading range. We may begin to signal this for long side trades going forward.

-Commodities Inflation– we’re long of commodities, I cant stress that enough. We added more Bloomberg Commodity Index positions this week as our “core” holdings/exposure to commodities, and we’ll continue to trade the individual commodity markets based on our trend and range analysis.