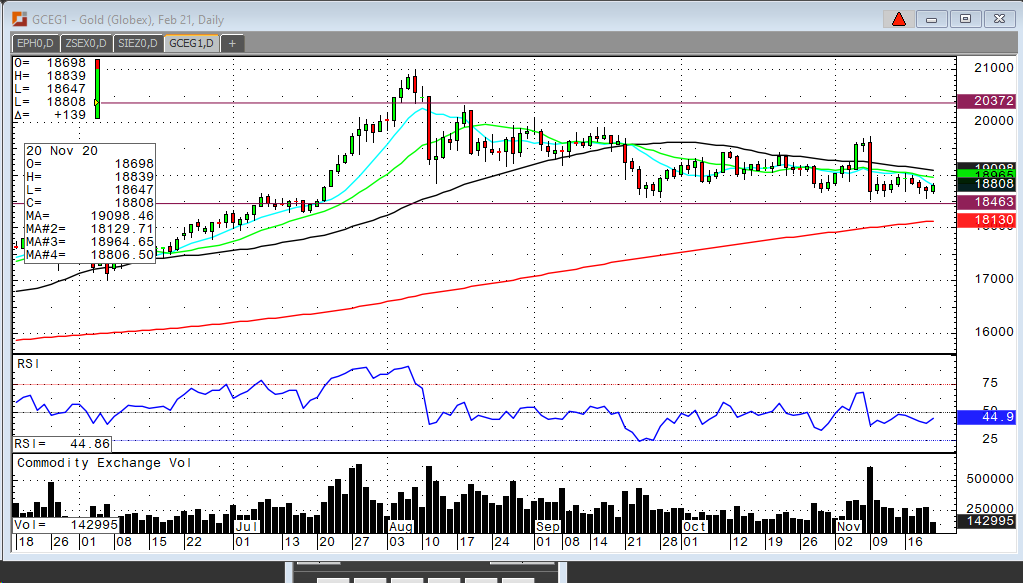

While the $1,850 support level in gold continues to hold, I am beginning to question whether that support level on the chart is enough. Gold futures are going to need some fundamental support. The vaccine announcement was the “stake in the heart” for gold. It doesn’t seem likely that additional stimulus is on its way. Afterall, we haven’t yet used all the stimulus funds from previous packages. The US Dollar still looks vulnerable to me and perhaps a little supportive to gold for the time being. Gold is going to have to see new contract lows in the dollar to recover from the vaccine sell off.

I’m still long-term bullish gold and believe that new contract highs are like first quarter 2021. However, it looks like it’s also very likely that we need to see a test of the $1,800 level before moving back above $1,900. There’s just more negative fundamentals in play right now and $1,850 is going to be taken out if it’s tested too many times. At the time of this writing gold is trading $1,875. Gold is finding some support in the raising number of COVID cases and additional lockdowns. Also, as mentioned, the Dollar doesn’t seem able to bounce. Maybe $1850 is the low, but I doubt it. Look for $1,820 to $1,805.