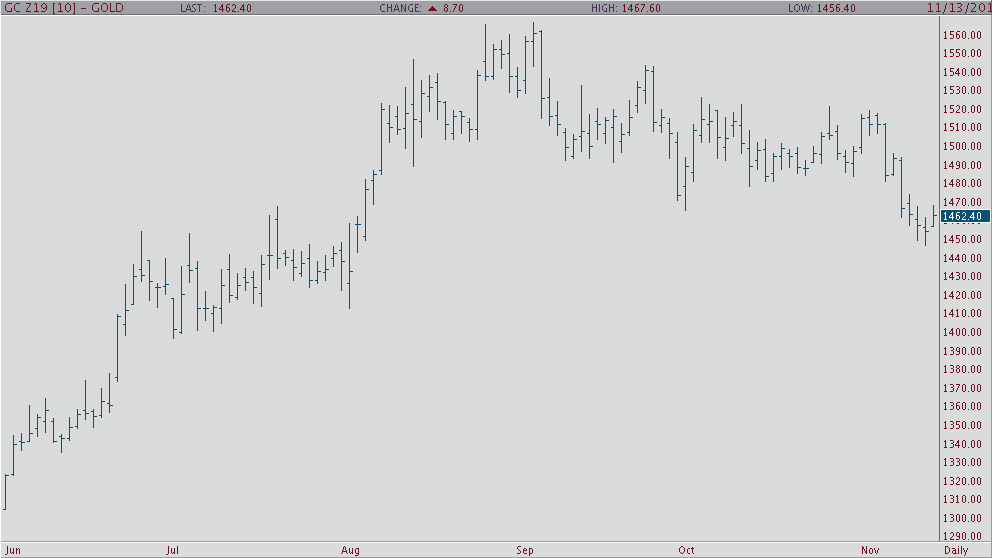

Stop me if you heard this before, gold is moving based off comments (or lack thereof) by President Trump on the China trade situation. December gold jumped up $2.85 to $1,453.70/oz yesterday afternoon after the President had very little to share on what was expected to be a partial trade agreement with China. While many people were disappointed Trump had nothing to say, gold investors were not part of them. Gold had been stuck in a rut and at a 3-month low of $1,445.68 before yesterday’s jump.

However, many traders see this latest move as smoke and mirrors. RJO Futures market strategist, Eric Scoles said “I’m still bearish gold in the near term, but I suspect it will require more positive presidential comments or headlines regarding tariffs and trade to push gold below what could be firm resistance at $1,450… “Should December gold close below that point, I’d expect the next target to be $1,425”.

Josh Graves, another market strategist at RJO Futures also is not too optimistic of gold saying “I do not feel like gold has enough juice to get us back $ 1,550 and beyond if we see softer economic data. We need a break from the norm for the actual direction.”

Gold is definitely moving, we just don’t know where it will be headed.