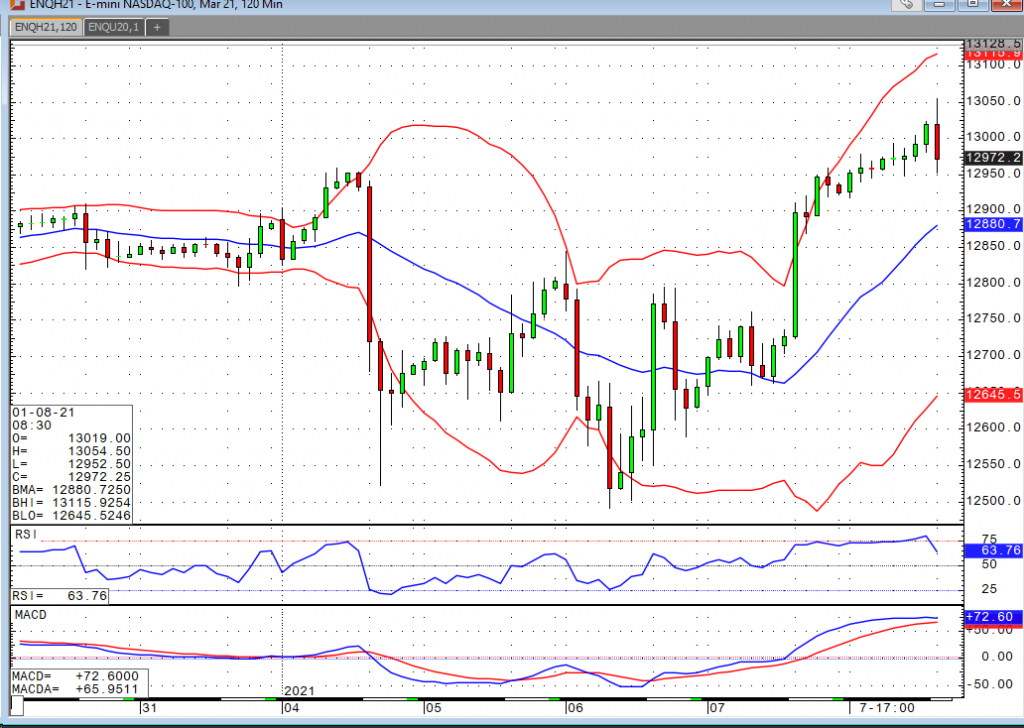

Today’s jobs data was expecting to see another 50k jobs added. Unfortunately, the number came out as having lost 140k jobs. The market initially reacted negatively to the news, but quickly recouped the losses. The Nasdaq has even printed a new, all-time high. Very little seems to be able to shake this market for more than a day or so. New record in positive coronavirus tests? Meh. We’ve got multiple vaccines. Political unrest/violence? Who cares? Not to mention businesses closing at an incredible rate, tax hikes a near certainty, etc. This market is on, and has been on, a tear. I’ve listed plenty of reasons (there are plenty that went unmentioned) for investors to be concerned, but the market seems to believe they too shall pass. Each and every dip is getting bought, and those participants continue to get paid. Until that stops working, why change it up?