U.S. Stock Futures hung on to their early gains while government issued-bond yields declined after a poor jobs report number that suggested a slowdown in the recovery of the economy. This month’s job report showed that employers added 266,000 jobs with unemployment rising to 6.1%. This was far from the economist’s prediction that jobs would grow by over 1 million and the unemployment rate falling to 5.8%. The 10-year Treasury note was down to 1.509 from 1.561% which was a decline for the sixth consecutive day. The disappointing data added to the concerns of bankers and economists who feel that there is still great downside risk in the U.S. economy recovery. The U.S. is still 8.2 million payrolls short of the pre-Covid pandemic levels and the unemployment rate and labor force participation are still off from the February 2020 levels.

“ Federal Reserve Chair Jerome Powell has suggested he would want to see a “string” of strong payroll gains totaling more than 1 million before the central bank considers adjusting its ultra-accommodative monetary policy posturing. With the April jobs report such a stark disappointment, it appeared the economy still did remain far from the central bank’s targets of reaching maximum employment, and would keep the Federal Reserve on hold with its current policies.”

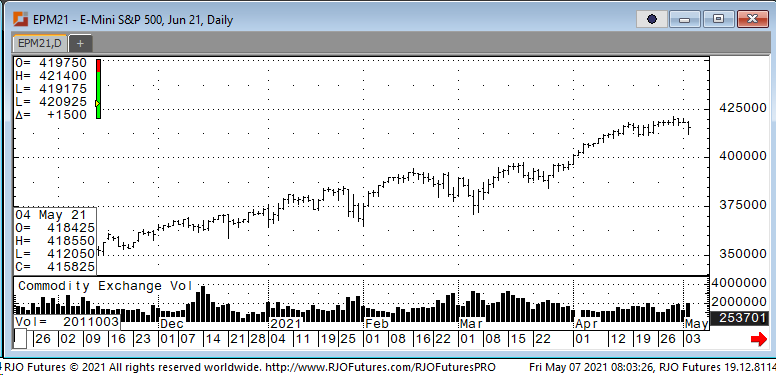

Resistance today is showing 422000 and 423500 with support checking in at 416500 and 412000.