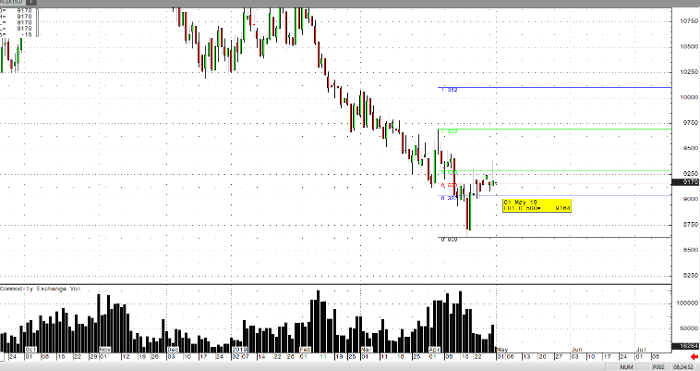

July coffee prices have seen a strong short covering rally extending over 61.8% retracement from the last major selloff stemming from April 4th. July coffee prices dropped with volatility from the 97 level to the 86 level in a hurry, so a strong pullback was due to take place. The Hightower Group has also reported that “lower coffee prices of late have prompted farmers in Brazil and Vietnam to hoard their inventories and not sell beans to roasters.” This may continue to add support to July coffee prices, but as always, strong bullish supply/ demand news is paramount to a recovery in this commodity. As I’ve written many times prior, we have yet to see any solid bullish supply news to reverse this falling market.

A strong U.S. dollar is still holding support above the 9700 level and remains in an uptrend, adding selling pressure many of the worlds commodity prices. I remain bearish on July coffee prices and would expect formidable resistance at the 9400 level in the near term. With such volatility on the horizon, I would advise using options to manage risk and gain exposure to a potentially large move in May coffee prices.

Coffee May ’19 Daily Chart