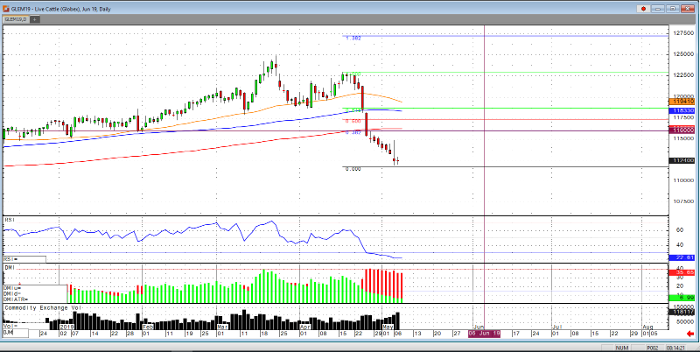

We saw some more selling in the June live cattle market yesterday and a close at 112400. During this time of the year, we should be seeing some increase in demand due to the grilling season causing an increase in price. Unfortunately, because of the record NET longs liquidating their positions the past two weeks and the disappointing trade news and tweets from President Trump, we saw the market continue to have a bearish tone early this week. The market is extremely oversold with the RSI at 22 according to the daily chart. The market right now is on support from last November and early December, a close under the 112000 level would lead a continued sell-off to the 111675 level. The Fibonacci Retracement taken from the April high would show a retracement back up to 116000 which is also around the 200-day moving average. If we see a close over the May 6th high within the next week then I believe the market continues to the .382 Retracement line at 116000. USDA boxed beef cutout values were down 98 cents at mid-session yesterday and closed $3.13 lower at $223.87. This was down from $231.84 the prior week and is the lowest beef market since March 4th.

The hog market took a huge blow from the breakdown of the trade talks and tariff threats which has ignited some more aggressive selling. This market still has problems with its tight supply which would drive prices up but as soon as there is confirmation that a trade deal is complete with China, until that point this market will trade sideways with maybe a slight upturn due to the tight supply. Along with the tight supply, we are coming into grilling season further increasing demand in the market. If there is anything other than bad news, I see this market forming a near term bottom and start to slowly turn to the upside.

Live Cattle Jun ’19 Daily Chart