Good morning,

Geopolitics of course dominated news flow over the weekend – First with Ukraine’s Zelensky condemning NATO and their unwillingness to get involved via securing Ukrainian air-space. Which initially I thought was a step in the right direction for them to finally be finding some middle ground with Russia and of course waking up to reality of their inferiority to the Russian Military. Then around mid-day on Sunday I find out that the US was considering (now official) allowing NATO/Poland to supply the Ukrainians with Mig 29 fighter jets, and then US backstopping the Poles with F16s. Of course the Russian defense minister released a statement condemning this and that Russia would view this as direct NATO involvement. So we’ve sanctioned them back to the stone age, but still purchase Russian Oil, and are also sending the Ukrainians weaponry and Billions in Aide – so in a sense, we’re financing both sides of this mess, how convoluted this all is – but that’s usually par for the course for the United States.

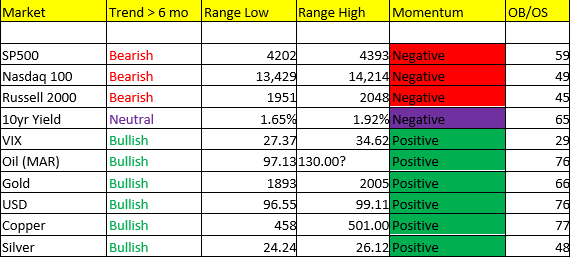

Markets crapped out on the open, Oil boosted $10.00 to as high as $130.00, Gold, Silver, Platinum prices ripped higher.

Price instability/surges at this stage of the game is highly likely going to drive us into a global economic recession. It’s not a forgone conclusion quite yet, but it’s highly probable this is how it ends. Price shocks in energy and food will undoubtedly create a contraction in consumer spending activity (the longer the persistence the worse, naturally), which of course makes up 70% of GDP, and the longer inflation remains sticky high, the deeper this Scenario 4 call in Q2 will be. Another interesting (but not surprising) development is that an interest rate cut is beginning to appear on the Eurodollar curve out in 2023 – solidifying what we’ve been pounding the table on since January – the Fed won’t be able to get away with 6 rate hikes, or is it 7, 8,9 – I’ve lost track. If you’re worried about the Fed raising on Mar 16th and maybe again in the following meeting – it’s already priced in, along with 5.5 more hikes – this is what we’re trying to exploit.

**10yr note yield is pressing our bull/bear line of 1.66% this morning as well – which will probably get plenty of CTA/trend following money to cover shorts if that level breaks, and ultimately get long.

**Remember- even in deep Scenario 4, Gold prices can take a hit in that “initial dash for cash” moment – this is important to remember when you’re thinking of chasing.

**CPI due up later this week – if it comes in hot (as we expect) there’s going to be opportunity.

DON’T FORGET TO SIGN UP FOR YOU FREE TRIAL OF ***MARKET INSIGHTS AND ***TRADE SIGNALS VIA THE LINK IN MY BIO AT THE BOTTOM!

Good luck,