Corn: Since Monday’s crop progress report, where corn G/E ratings went up to 72% which was higher than the expected 69% and higher than the top end of the estimate at 71%, we have seen some weakness in corn. This has sent prices about 4-5 cents lower on the week and breaking some important TL support and closing below the TL support as well, which is looked at as a bearish technical setup. Assuming weather remains bearish and no surprise demand news, I would expect corn to test their recent contract lows from before the June 30th report around $3.22.

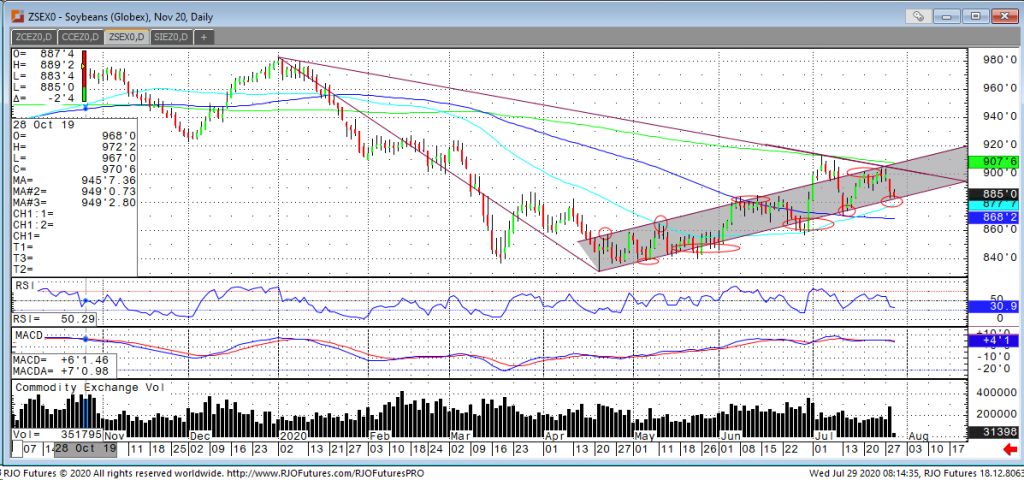

Soybeans: Like corn, beans also improved on the crop progress report up to 72% G/E vs expectations of 69%-70%. Beans are in a position to see more downside with improving crop on top of less threatening weather. Outside of Minnesota and N. Iowa, most areas are expected to see good rains in the next 6-10 days. It looks to be testing strong TL support that has proven to hold in the past, so this will be a big test to see if we break below that $8.80 level. Sellers have remained active, but don’t be surprised to see a technical bounce around here.

If you’d like to learn more about the agriculture markets, please request our exclusive 2020 Grain Futures Outlook. If you have any further questions or needs, please contact Tony Cholly at 1-800-826-2270 or email him at tcholly@rjofutures.com

Our 2020 Grain Outlook Includes:

– World Corn Outlook – Stock Change vs. Usage Ratio

– U.S. Soybean Export Sales and USDA Forecast

– U.S. Planted Wheat & World Wheat Production

– And Much More!