The big news of the day is the release of Robert Mueller’s report that sums up his investigation into whether the President and his campaign colluded with Russia. The news has basically been out there for weeks now, so I don’t think there will be a great deal to pull from in a slightly redacted report about the findings. I’m sure the politicians and media will find a way to spin it into something bigger than it actually is, but the market doesn’t seem to care. The morning has been spent chopping around unchanged for the most part in the indices. The Dow has been a bit stronger than the rest of the pack and is up nearly half a percent. There has been some renewed optimism regarding a trade deal with China, but we still don’t have anything set in stone. It appears it will be several more weeks at best on that front.

All the indices are approaching their all-time highs. The Nasdaq actually printed a new one intraday yesterday. If earnings can continue to come in in line or relatively strong, it appears we’re going to bust through the swing highs. Markets are closed for the holiday tomorrow, but next week features a decent slate of news. Highlights will be Existing Home Sales on Monday, New Home Sales on Tuesday, Durable Goods on Thursday, and GDP on Friday.

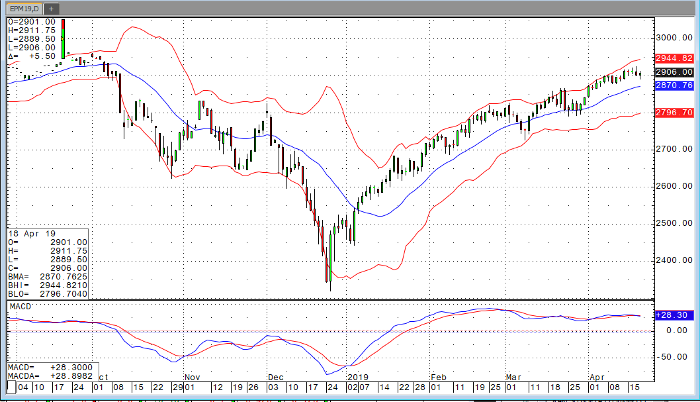

E-Mini Jun ’19 Daily Chart