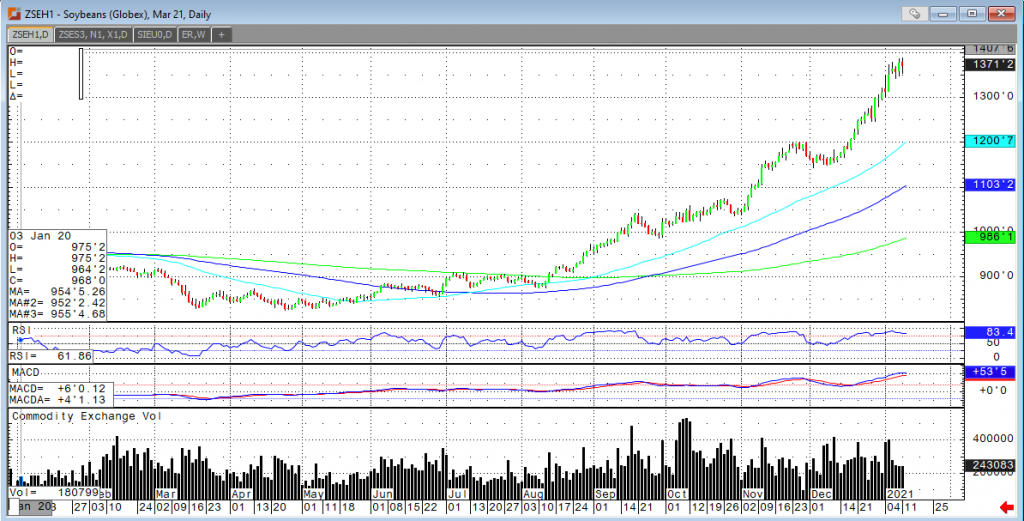

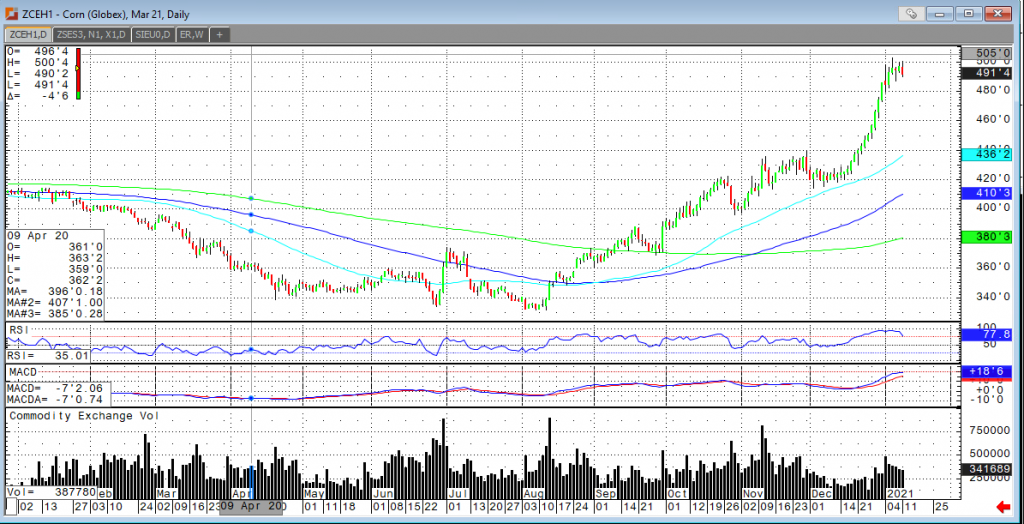

The grain complex has been extremely volatile for over the last 4-6 months, with Soybeans rallying over $4.50 and Corn $1.60. The majority of this rally has been from fears of dryness in South America and how much damage the dry spell has done to corn and soybeans. This catalyst was just the start, though. We then started to price in the expectation of USDA lowering ending stocks, which they failed to do on the last report, as well as China demand (or not many cancellations, at least), and finally the fears of inflation for commodities is kicking in from a weak USD. It has really been a “perfect storm” of bullish catalysts to support this move higher, but as we all know, nothing goes higher forever. This leads us to trying to decide where the grains are fairly priced for everything that is happening right now. Some questions come to mind, is the SA crop completely ruined, because that seems to be how the market is pricing it right now? Will China still come in and cancel purchases? Is the USDA going to continue to act as if we have more grain than we do? One bullish catalyst I do not see going away is inflation. I expect the Biden/Harris administration to continue to print money to support the American people, without concerns of the economic outcomes from this, which should continue to result in a devalued USD/higher commodity prices. That being said, I can see the other bullish factors fading, or at least not being as severe as feared. “Bad news” tends to get priced in far earlier than the news comes to fruition.

In other words, we may over-estimate how bad things actually are, just to be safe, and then when the dust settles the, the market may realize it over-priced the negative news from SA or overpriced how much China demand there was (for example). In the end, I think we are closer to a top than a bottom, but by no means does that mean a move to $14+ isn’t possible, because it is. Volatility like this provides great opportunities to use option trading, so always keep that route in mind.

If you’d like to learn about the opportunities that exist in the grain markets right now, please request our exclusive Agricultural Investor Kit. If you have any further questions or needs, please contact Tony Cholly at 1-800-826-2270 or email him at tcholly@rjofutures.com

Our Grain Investor Kit Includes:

– In-Depth Fundamental Analysis and News on What is Currently Moving the Grain Markets

– Technical Analysis Overview with Possible Outcomes

– Analysis on Current Trends and Opportunities in the Market and How to Take Advantage of Them

– Historical Charts and Data Outlining Historic Prices and Trends