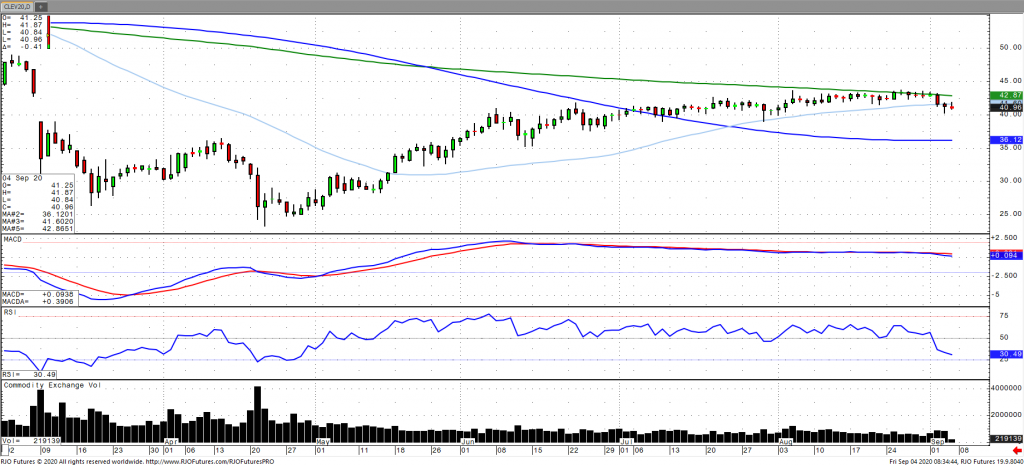

Oil prices have largely recovered following an early 3% drop yesterday as continuing claims continued to rise increasing concerns of a slowing in economic recovery and fuel demand. This comes as data from the EIA showed gasoline and distillate demand readings fell. Refinery runs are set to be operating at a low rate, which will only further dent demand for oil. Reports of slowing Chinese demand due to restocking has continued to weigh on sentiment as well as reports that Iraq may be looking for an exemption of OPEC plus production cuts. A firmer dollar over the course of the last couple of sessions has also contributed to the downward pressure on prices. The market remains bullish trend with today’s range seen between 40.95 – 43.88.