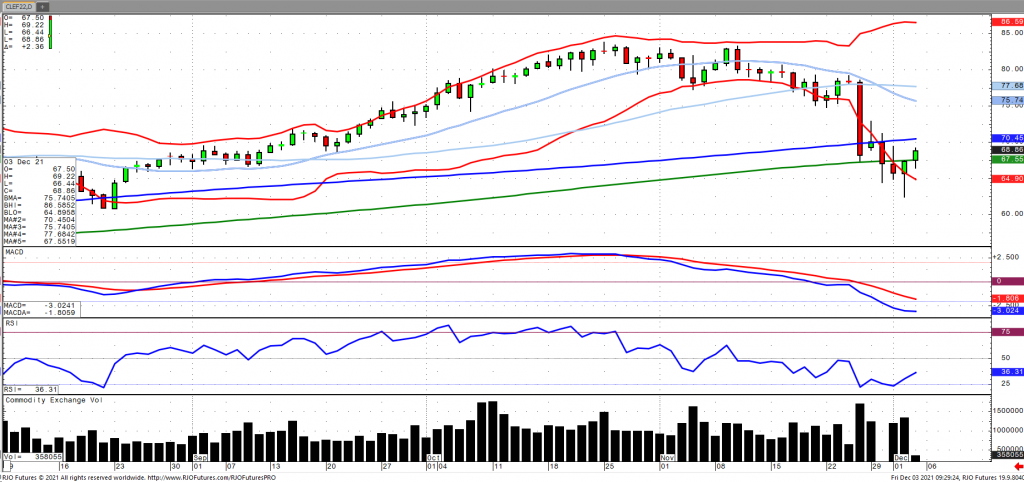

Oil prices appear to have found their footing as they clawed back early losses yesterday as OPEC+ have agreed to continue with their scheduled output hike of 400,00 barrels per day in January following record cuts last year. However, OPEC+ noted that they can make ‘immediate adjustments’ if need be as the market assess the impact of the COVID variant on demand, specifically fuel demand. Crude stocks fell -909k barrels last week with stocks now -54.931mb below last year and -29.321mb below the five-year average, according to the EIA. Oil volatility (OVX) has continued to remain elevated despite coming off its most recent high of 78 to 55-60 with the market transitioning to bearish trend with today’s range (due to the volatility) seen between 60.95 – 81.57.