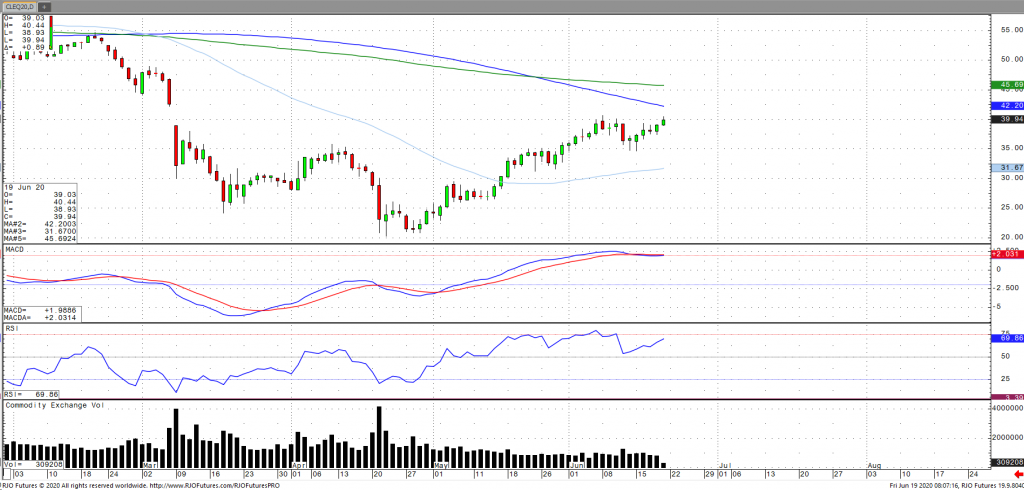

Oil has continued to extend higher leading the reflation ramp up, hovering just above $40 a barrel as the market attempts to digest supply and demand prospects. Renewed concerns regarding an uptick in corona cases in Beijing and parts of the US have weighed on sentiment as well as recent reports that Indian crude oil imports fell to its lowest since 2014 last month. This has been buffered by a record output cut by OPEC plus cutting nearly 10 million barrels a day or nearly 10% of output since May 1. OPEC’s joint ministerial monitoring stated on Thursday that compliance was near 87% for the month of May, reiterating cuts are continuing through July with noncompliant countries retroactively responsible for any missed targets. Weekly inventories for US stockpiles rose for the second consecutive week, however, inventories of gasoline and distillates fell, indicating improving demand. To note, Brent moved into backwardation on Thursday for the first time since March, which typically indicates tightening supply and increasing storage withdrawal. Oil volatility (OVX) remains highly elevated with the market now transitioning to neutral trend with today’s range seen between 35.67 – 41.25.