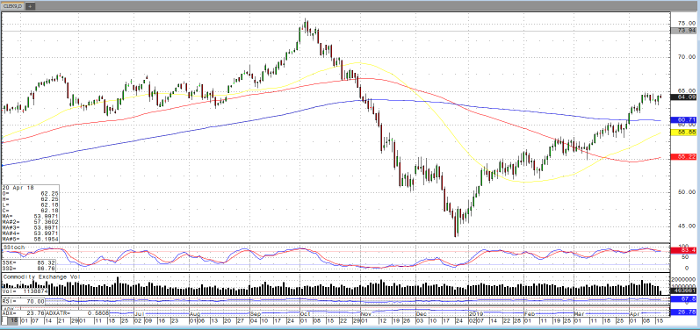

As of Wednesday, the crude oil market is only slightly up with the May 2019 futures contract trading just above $64 per barrel. The weekly EIA reported today crude oil inventories were down 1.4 million barrels to 455.2 million, 6.5 percent above their level a year ago.

As the market trades near the $65 level, which it has not traded at since late last year, traders may consider whether we are looking at a bull flag prior to legging higher. Traders may also consider pausing and potentially turning or profit taking as the market has had a strong year and is trading near the year’s highs amid a number of managed money traders and hedge funds add to bullish bets in what could become a crowded trade.

For me, in addition to fundamentals, outside markets should be a consideration as the demand for energy is directly related to global economic health and risk on sentiment. While equities trade near all time highs and gasoline is strong, these should be bullish factors for crude. Should these markets turn, especially equities akin to the end of last year, then it is another story.

It is also interesting to note reports from Reuters showing:

-record gasoline to the U.S. West Coast from Western Europe amid refinery outages

-possible extensions on Iranian waivers for Turkey

-mixed reports with higher exports from Iran, UAE and Qatar and lower exports from Saudi Arabia, Oman and Iraq

Crude Oil May ’19 Daily Chart