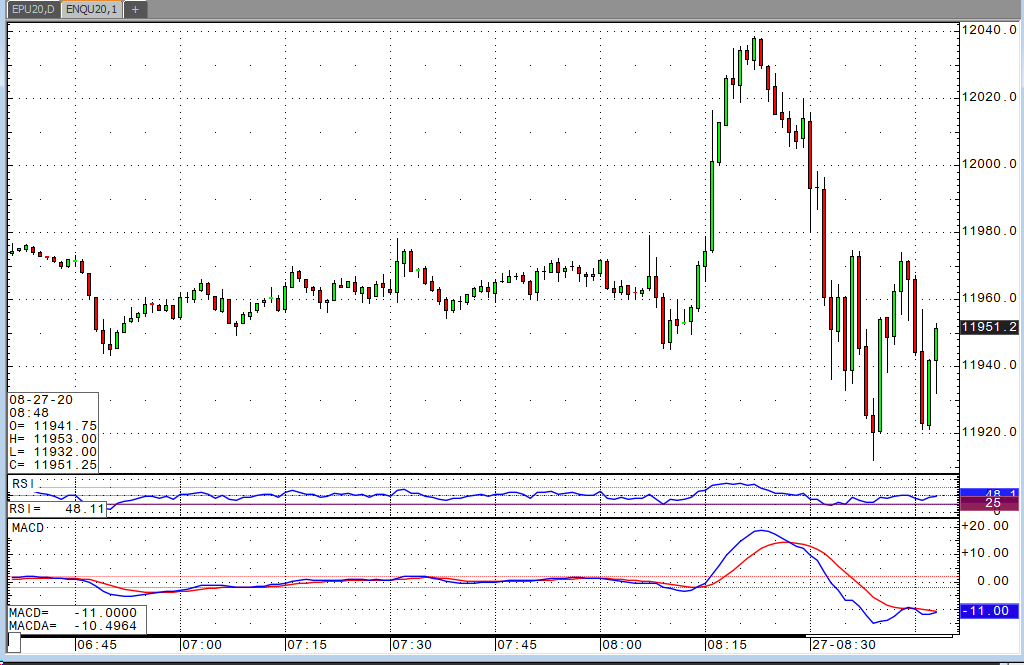

The S&P and Nasdaq were underwater heading into Fed Chair Jerome Powell’s statement from Jackson Hole, Wyoming. During the speech, we saw a nice rally, but it has quickly faded. The big takeaway from the speech was that they will allow inflation to run above their stated target rate of two percent. Their new policy will be one of “average inflation targeting.” In other words, following periods where inflation is running below their two percent goal, they’ll allow it to run above two percent for a given period to average two percent. He also cited the risks that extended periods of low inflation can present to the economy, acknowledged that the Fed has been unable to achieve their two percent target, and reiterated that they remain firm in their belief that two percent is the ideal target rate.