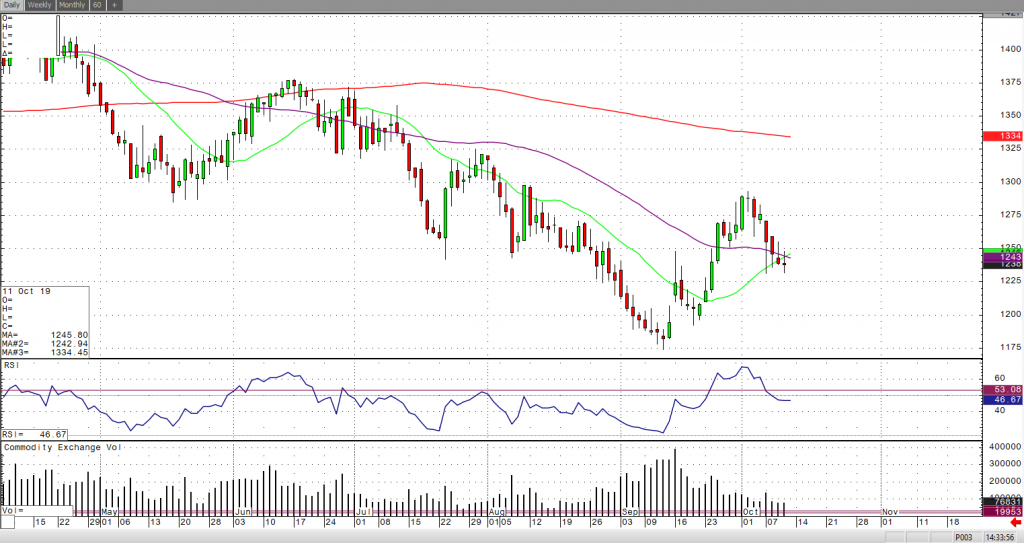

This week’s comment finds the March sugar contract retracing gains posted in September. Short covering and talk of production deficit for 2019/2020 has provided support to March sugar for weeks. but the last 5 trading sessions have seen this support erode. Failing just under 13.00, at 12.93 to be exact, the March contract has fallen all the way to 12.31. A feature of the recent rally was short covering. The Fund trader was still short about 176k contracts as of October 1. This size short position was a surprise to me. The March contract had rallied above levels where we would normally see the Fund trader getting flat, or even long. We will get another view of this position with Friday’s updated COT, the March contract could be at an inflection point. Again, we see producer selling cap a rally in sugar. If there is more producer selling to be done and the Fund trader gets pushed back into a bearish tilt, we could be headed for a test of the lows. A close below 12.22, forces the fund trader to begin establishing new short positions. The 18-day moving average comes in at 12.47. The longer sugar stays below this level the heavier it is going to look on the chart. March puts give bearish traders short exposure until February 15 of next year.