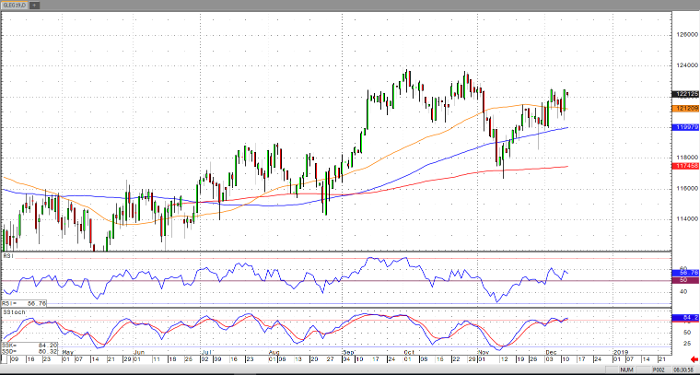

Yesterday, we saw a rally in both the feeder and live markets with a close in the Feb live cattle above the 50-day moving average at 122.475. Exports of beef from Brazil have an expectation to reach a level of about 1.6 million tonnes for the year of 2018, with next year having an expectation to reach a record level of 1.8 million tonnes. China has emerged as the world’s largest importer of beef, but not necessarily from the U.S. In 2018, China will import roughly 4,000 tonnes of U.S. which is a fraction of the amount they will import from countries like Brazil. Overall, the major trend in the market could be turning up with that close above the 50 DMA, the next upside target in the market is 123.900 and test the contract highs. Boxed beef cutout values are lower on choice cuts and firm on Select cuts. select and choice loin cuts are steady while chuck and round cuts are firm. Choice rib cuts lower while Select weak. Beef trimmings mostly slightly lower on light demand and offerings.

In the pig market, we are seeing the market in the process of correcting itself with the overbought conditions and the wide basis due to the still high number of near-term supply. The market gapped lower on the opening yesterday which continued to draw new sellers into the market, driving down to the lowest close since November 28th. USDA pork cutout values were $71.35 which was up 17 cents from Monday and up from $69.78 in the previous week. The outlook into 2019 for the pork market remains bullish.

Live Cattle Feb ’19 Daily Chart