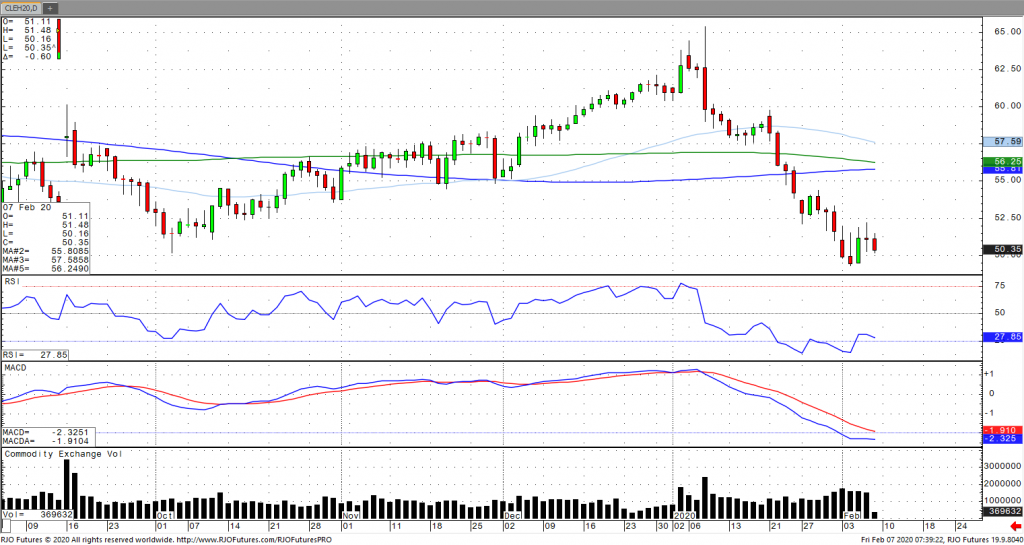

Oil is headed for a fifth weekly loss as prices have remained aligned with Chinese demand prospects as the threat from the coronavirus continues to settle out. Prices for the last few sessions have looked to an emergency session by OPEC and Russia to further cut production in order to underpin the market, as demand could temporarily drop by 1 – 2 million barrels a day. However, this appears unlikely as Russia is unwilling to compromise with the recommended reduction of 600k barrels a day, down from 800k to 1 million barrels a day. In addition, China moved to reduce tariffs this week on $75 billion worth of goods, which would set to curtail ongoing demand fears. Geopolitical risk remains high as the Katyusha rocket attack on the US Embassy compound in Baghdad the other week exemplifies. This comes amidst the oil market largely fading geopolitical risk between the US and Iran following a non-response by President Trump to the missile attack at the Al Asad air base in Iraq. The market is now bearish trend with today’s range seen between 48.77 – 54.18.